Product Information

Stability Reflects Family Aspirations

Definitely, families need to have a solid plan to safeguard their stability and those of their future generation. A prime protection plan helps realize this aspiration and guarantees a secure and stable future for the family. Prime protection is designed to consistently maintain the quality of life for families and their lineage.

To support stability of families and their future generation, Manulife Indonesia and Danamon collaborated to provide Proteksi Prima Masa Depan (PPMD), a life insurance plan offering long-term protection benefits for future funds with Pillar 3A advantages.

Andal (Reliable)

- Protection starts from the age of 30 days

- Guaranteed Issuance Offer until age of 70*

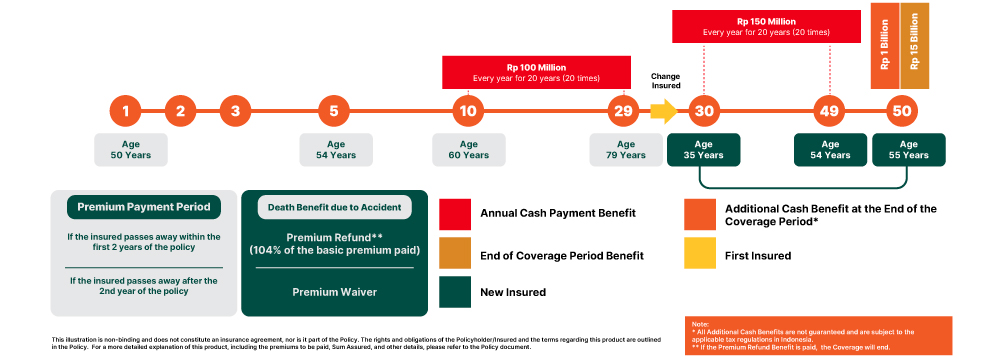

- Total of up to 600% future funds in the form of annual cash payment benefits and end of coverage benefits

Adil (Fair))

- Annual cash payment benefits start from the 10th year until the end of coverage period

- Period of coverage until the 50th year of the policy

Andil (Equitable)

- Multi Generation, the policy applies to the next generation**

- Additional cash benefit of up to 1500%*** future funds upon end of coverage period

**Maximum of 3 changes to the insured/policyholder during the insurance period

***Using moderate rate of return scenario for Rupiah currency

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service