Proteksi Prima Perlindungan Utama – Key Advantages:

- Affordable Premiums starting from IDR 24,000,000 / USD 2,400 per year

- Optimal Sum Assured up to IDR 10 billion / USD 1,000,000

- Hospitalization Benefits reimbursed based on actual bills*

- Investment Benefits from the First Policy Year:

- 50% in the 1st Policy Year

- 100% in the 2nd to 10th Policy Year

- 102% from the 11th Policy Year onwards

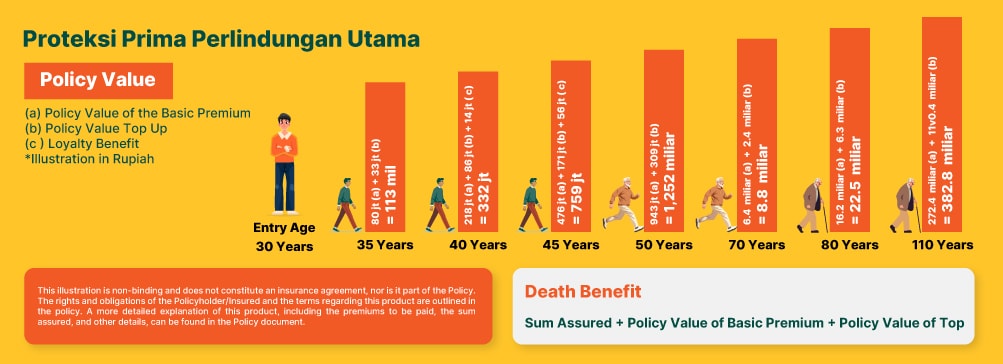

- Loyalty Benefits in the 10th and 15th Policy Year:

- 50% of the Basic Premium of the 1st Policy Year, payable at the end of the 10th Policy Year

- 200% of the Basic Premium of the 1st Policy Year, payable at the end of the 15th Policy Year

*Available as an additional insurance option

Description of Benefits

-

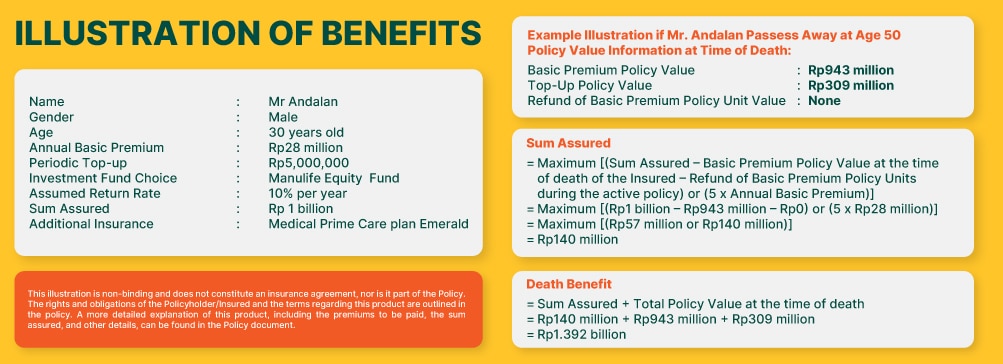

The insurer will pay death benefits to the insured, who dies during the insurance coverage period with an active policy status, the amount of the insurance value plus corresponding policy value (if any).

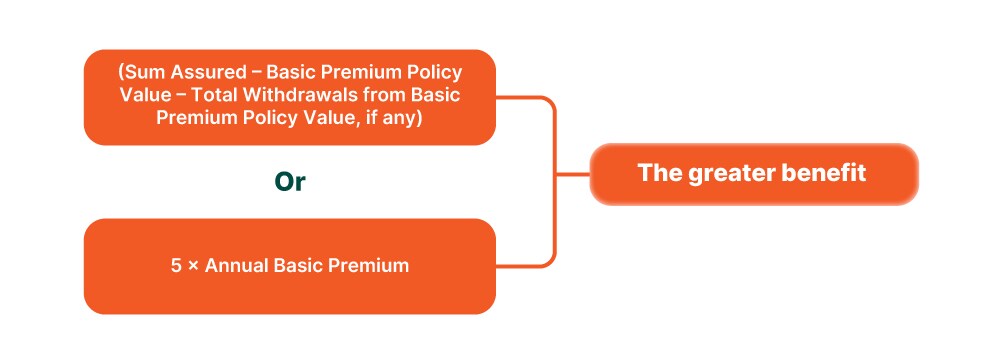

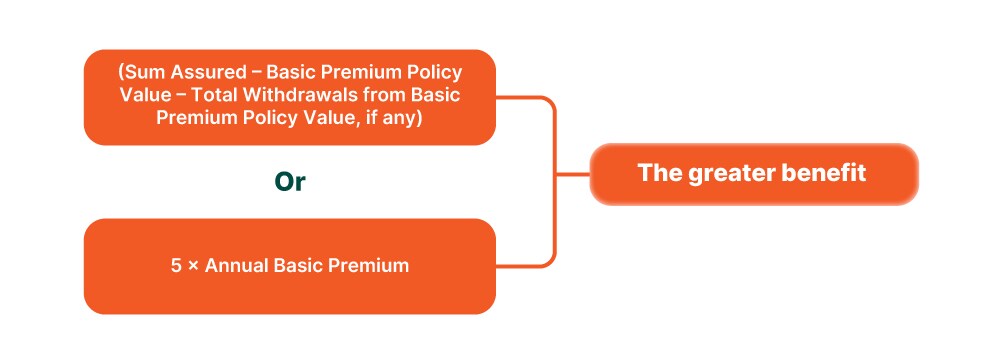

The coverage value:

-

End Of Insurance Benefit

If the insured survives beyond the insurance coverage period, the benefits at the end of the insurance period will be paid in the amount of the corresponding policy value (if any).

-

Loyalty Benefits*

- This is an additional percentage of the Basic Premium which will be added to the policy value of the Basic Premium in the form of units, the value of which corresponds to applicable unit cost provisions.

- This will be paid at the end of the 10th (tenth) year of the policy in the amount of 50% (fifty percent) of the Basic Premium of the first year of the policy, and at the end of the 15th (fifteenth) year of the policy at 200% (two hundred percent) of the Basic Premium’s first year.

Terms and Conditions

-

Terms and Conditions of Entry Age

- Insured: 30 days – 70 years

- Policyholder: Minimum 18 years old

-

Underwriting Process:

-

Premium and Money Insurance

- Currency: IDR/USD

- Minimum Premium: IDR 24,000,000 / USD 2,400 per year

- Payment Methods: Annual / Semester / Quarterly / Monthly

- Payment Period: Until insured reaches 109 years

- Maximum Sum Insured: IDR 10 billion / USD 1,000,000

Note: Must comply with minimum premium requirements

Investment Fund Options

| Investment Fund |

Investment In |

Risk Level |

| Manulife Equity Fund (IDR&USD) |

Stocks listed on IDX |

High |

| Manulife Equity Fund Indonesia-China (IDR&USD) |

IDX & HK Stock Exchange |

| Manulife Equity Fund Indonesia-India (IDR&USD) |

IDX & India Stock Exchange |

| Manulife Equity Fund Small Mid Capital (IDR&USD) |

Small/mid stocks on IDX |

| Manulife Equity Fund Syariah (IDR) |

Syariah stocks on IDX |

| Manulife Equity Fund Asia Pacific (IDR&USD) |

Asia-Pacific exchanges |

| Manulife Equity Fund Indo-Developed Market (IDR) |

IDX & developed market exchanges |

| Manulife-Schroder Equity Fund Premier (IDR) |

Publicly traded stocks (esp. LQ45) |

| Manulife Equity Fund Global Dollar (USD) |

Global stocks & mutual funds |

| Manulife Balanced Fund (IDR) |

Stocks & bonds on IDX |

Medium |

| Manulife Prime Fund Dynamic-Aggressive (IDR) |

Stocks/bonds/money market (aggressive) |

| Manulife Prime Fund Dynamic-Moderate (IDR) |

Stocks/bonds/money market (moderate) |

| Manulife Corporate Fixed Income (IDR) |

Corporate/government bonds |

| Manulife Fixed State Income (IDR) |

Govt. bonds (IDR) |

Low |

| Manulife Fixed Dollar Income (USD) |

Govt./Corp. bonds in USD |

| Manulife Money Market Fund (IDR) |

High-quality money market (<1yr) |

Information on Investment Fund Options Table:

- The minimum allocation for each Investment Fund option is 10% of the total Investment Fund. The selected unit-linked Investment Fund currency must match the policy currency. The Selling Price is the price used in purchasing the unit. Withdrawal or switching follows the Buying Price, while Top-Up uses the Selling Price (the Buying Price and Selling Price are determined every trading day). The difference between the Selling Price and the Buying Price is 2%. You can view the Buying Price and Selling Price on the website www.manulife.co.id. Depending on the selection, the Investment Fund management fee is 1.25% to 2.6% per year of the Total Managed Fund. Manulife Indonesia, which officially manages the Investment Fund, has the right to outsource the management of Investment Funds to third parties in accordance with applicable regulations.

- You can only choose one

ENJOY A VARIETY OF ADDITIONAL INSURANCE OPTIONS

- MEDICAL PRIME CARE*

Medical Prime Care Advantages:

In-patient benefits are paid according to the hospital bill (as charged) for various treatment costs in accordance with the provisions of the selected plan.

The cost of cancer treatment (chemotherapy) and dialysis due to kidney failure is paid according to the bill (as charged).

Additional Annual Benefits of up to Rp15 billion will be provided for 1 year if the Insured is diagnosed with a specific disease (cancer, heart attack, kidney failure and organ transplant).

- CRITICAL PRIME CARE*

This is an Additional Coverage Program that provides Protection Benefit of up to 300% of the Total Basic Insurance if the Insured is diagnosed with any of 56 end-stage Critical Illnesses without reducing the Basic Insurance Sum for Death Benefit.

- ESSENTIAL WAIVER OF PREMIUM*

This is an Additional Coverage Program that provides Basic Premium Exemption Benefit if the Insured is diagnosed with one of 49 critical illnesses without reducing the Basic Insurance Sum for Death Benefit.

* Refer to the policy provisions for full terms and conditions

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service