Product Information

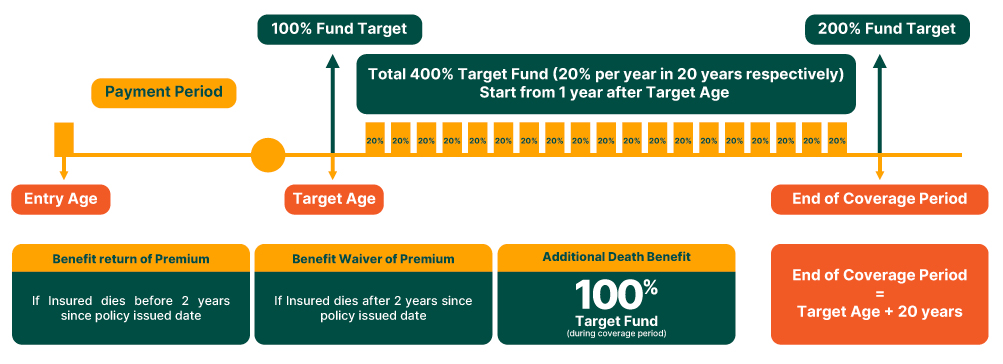

Proteksi Prima Emas Plus (PPEP) is a financial planning program that features financial protection to equip you in facing various challenges at every stage of life which enables you to prepare inheritance for your loved ones.

Each person’s dreams for their future is unique. However, all of us aspires to have a peace of mind. To reach it, proper planning is needed.

Proteksi Prima Emas Plus Solution to your needs

- Providing you with future earnings

- Granting you a peace of mind and comfort in life, helps you to achieve your dreams and prepares you for your golden days

- Ensuring the welfare of your families and later generations

- Preparing the future for the next generation

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service