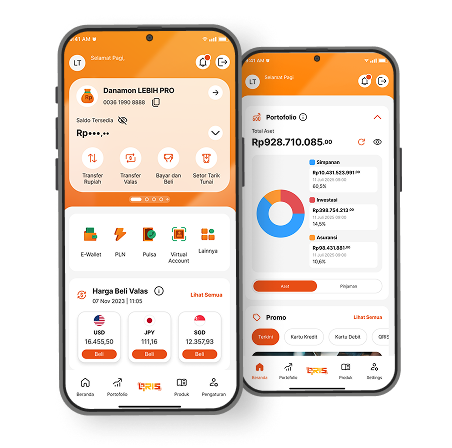

Personal Loan

Dana Instant

Mortgage

Automotive Financing

Latest Promotion

See All

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service