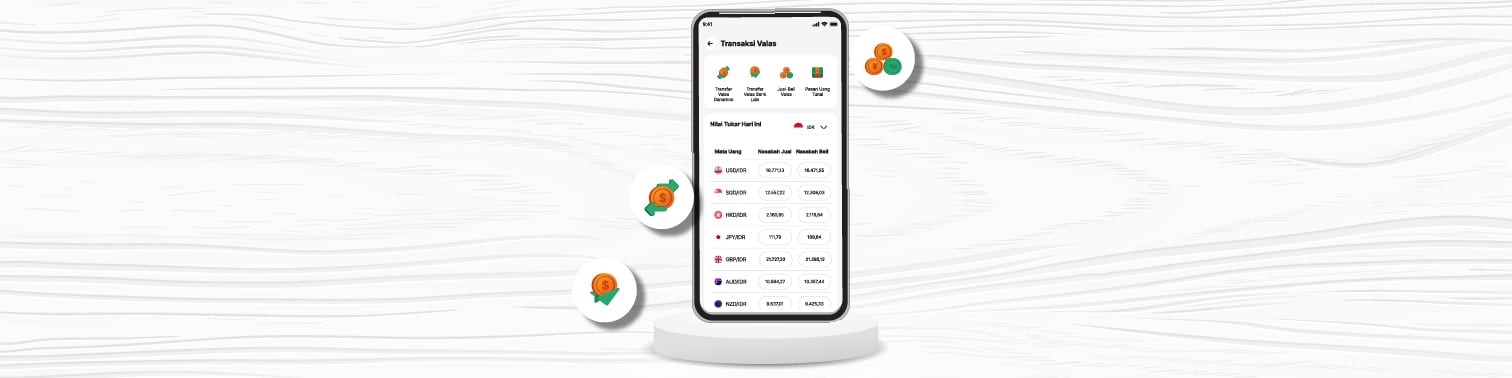

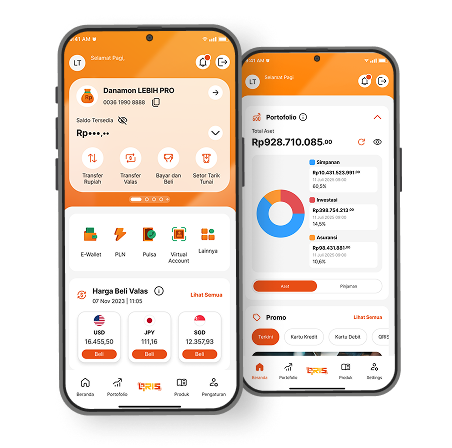

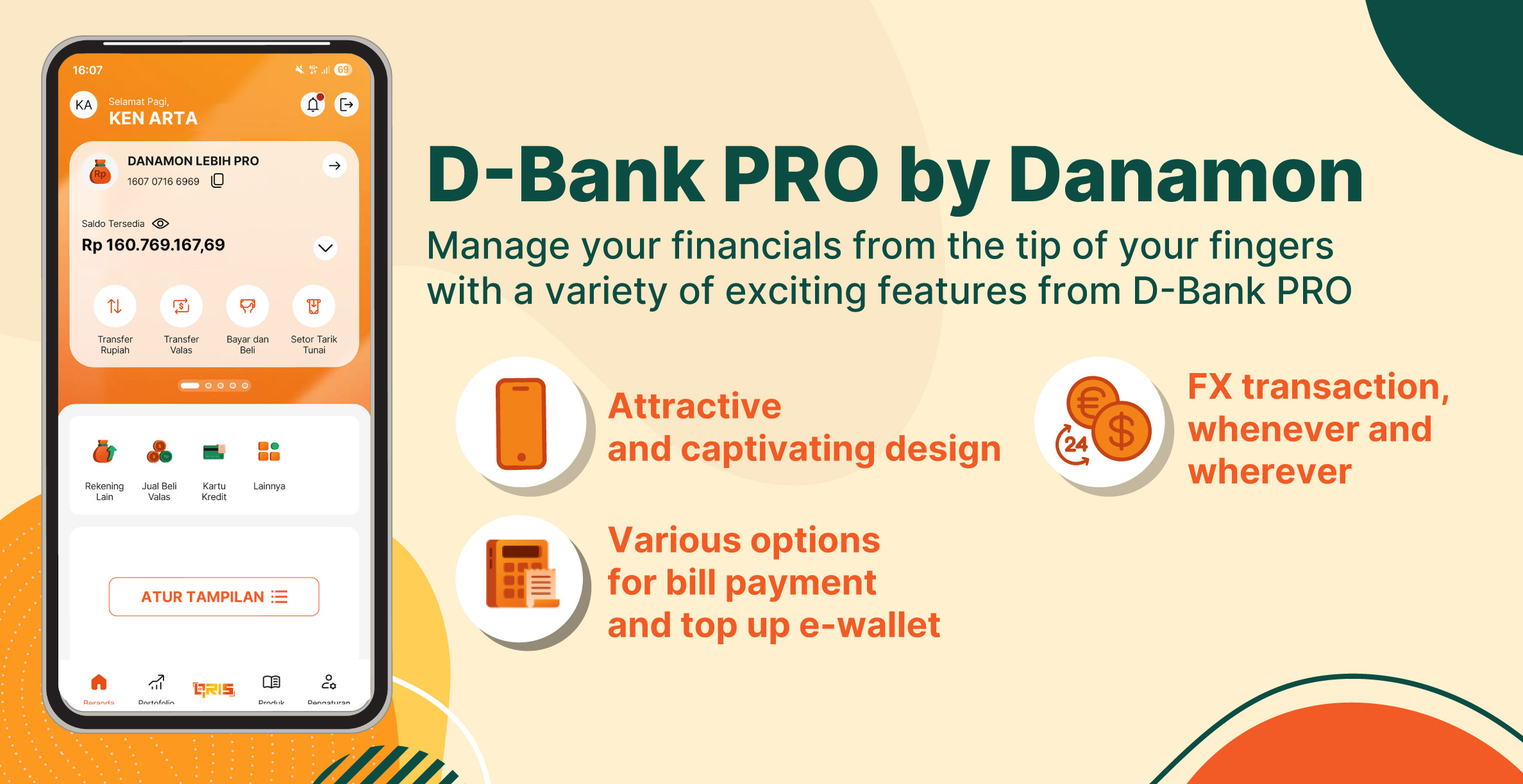

E-Guidebook D-Bank PRO

Summary of Product and Service Information D-Bank PRO

Terms and Conditions D-Bank PRO

FAQ D-Bank PRO

Latest Promotion

See All

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service