Product Information

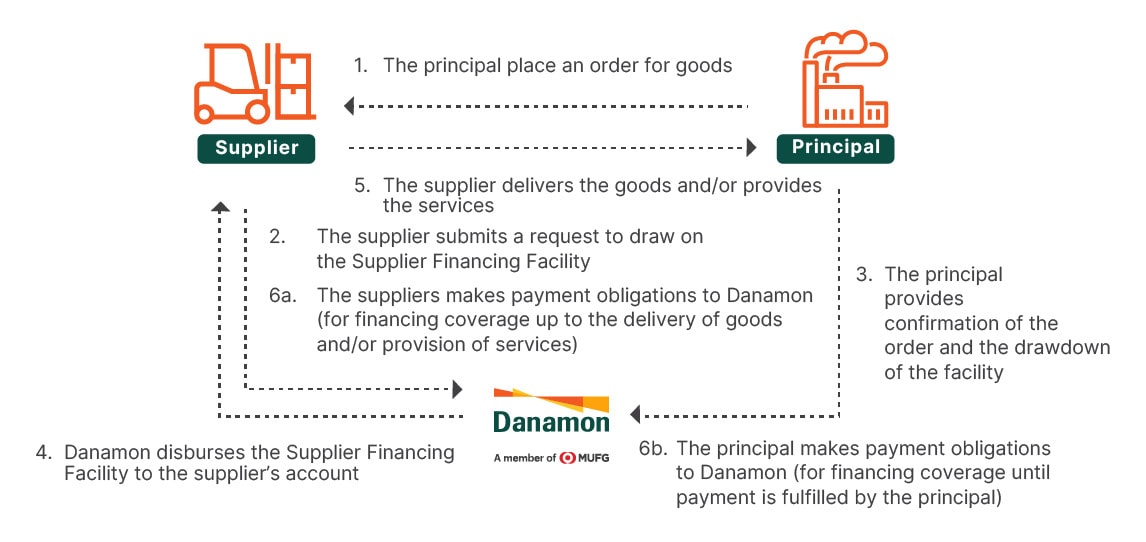

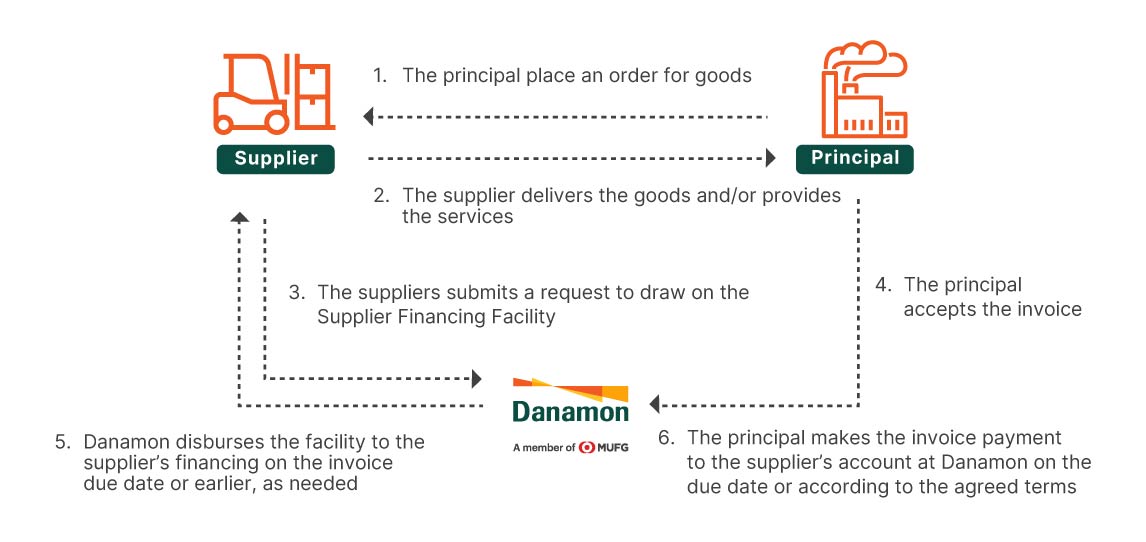

Financial solutions to optimize the supply of raw materials/services and cash flow.

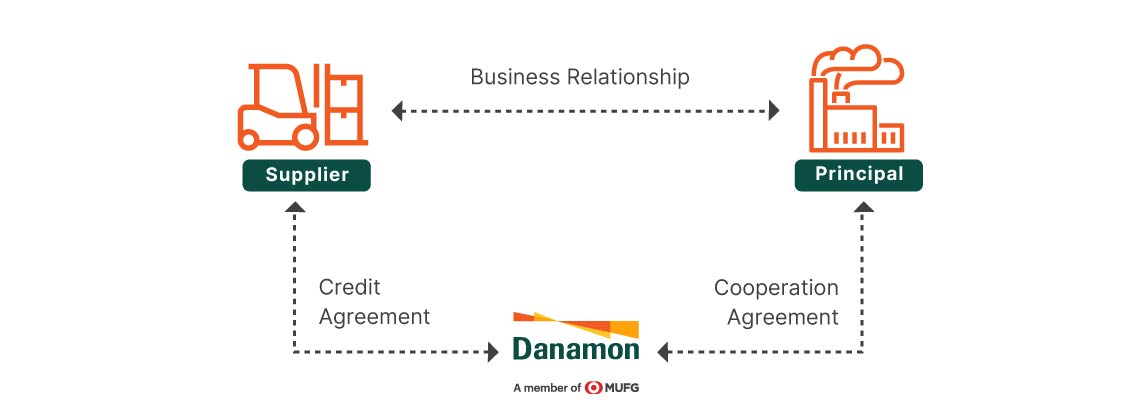

Danamon is committed to provide solutions through working capital support for selected Suppliers to ensure a steady supply of raw materials/services for the Principal.

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service