Product Information

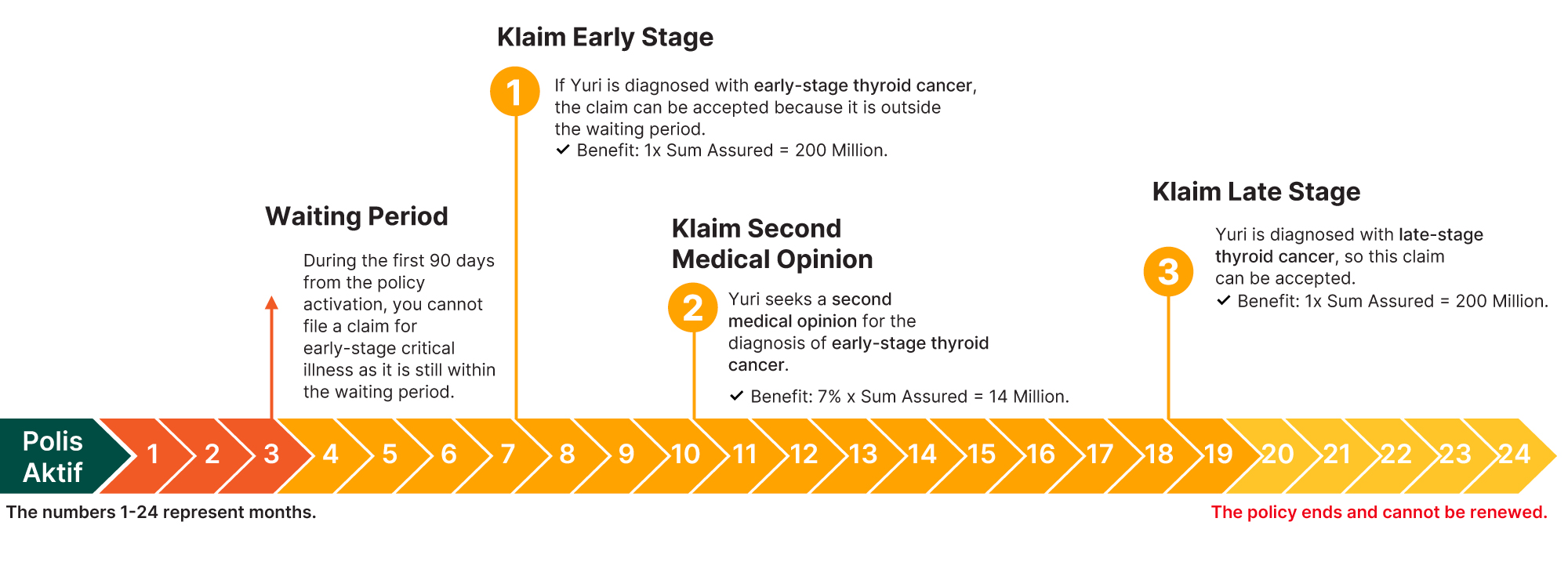

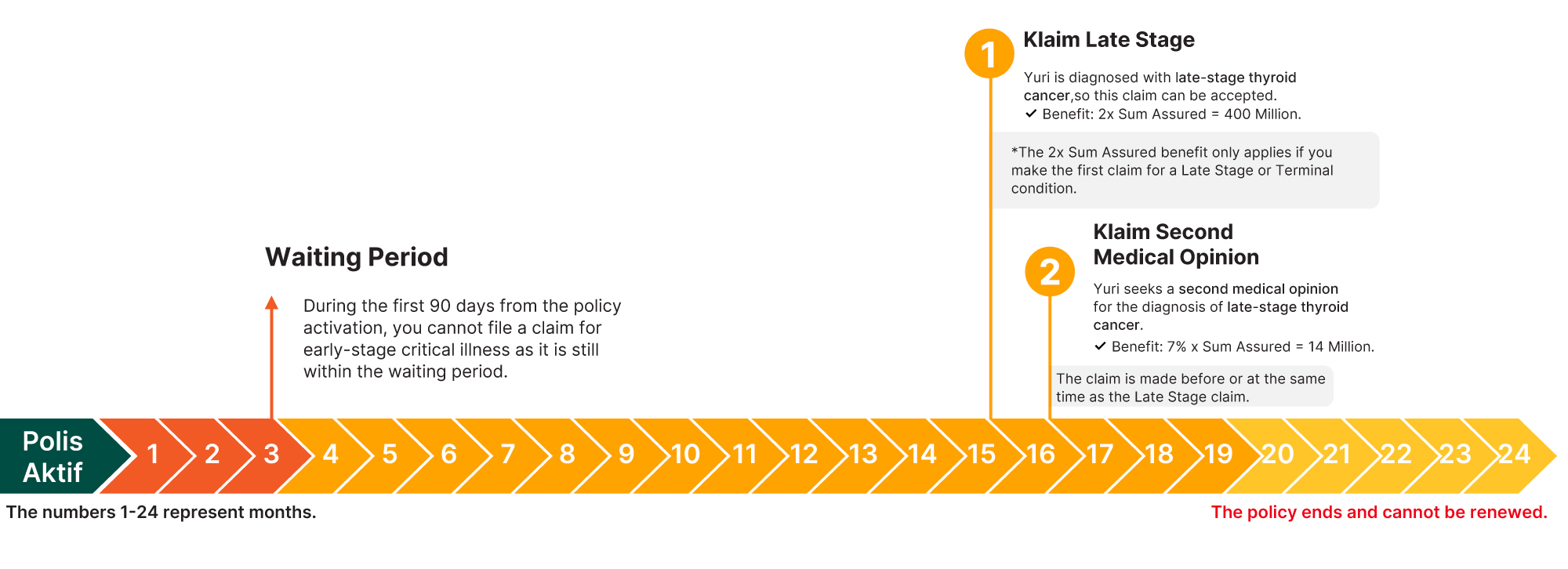

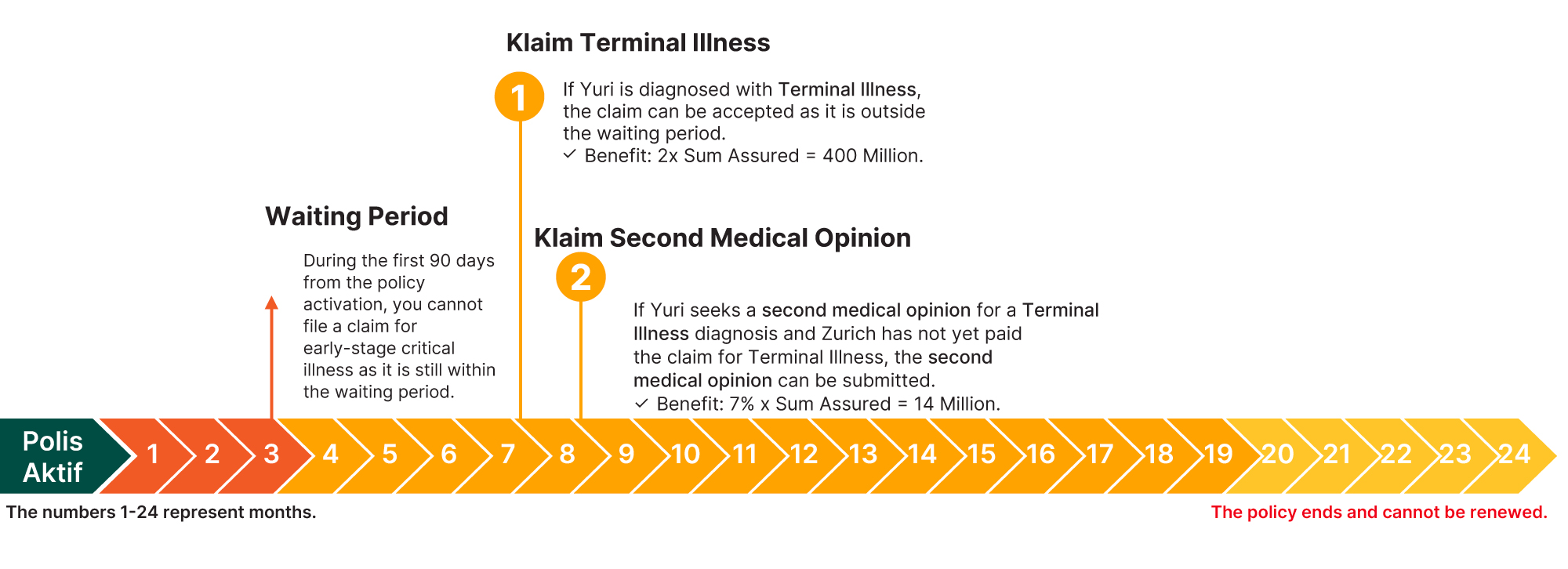

Perlindungan Optimal Penyakit Kritis is insurance that provides benefits in the form of compensation if you experience early-stage critical illness, advanced-stage critical illness, terminal illness, and a second medical opinion.

Take the first step to protect yourself and your family with the Perlindungan Optimal Penyakit Kritis insurance, covering unexpected health risks with comprehensive benefits and affordable premiums.

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service

.jpg?h=650&w=1500)