Features

- Various payment channels (branch and online)

- Various types of state revenue payments

- Payment process and Payment status that can be monitored online

Benefits

- State revenue payments that can be made single or multi-billing via (DCC) and Bank Danamon Branches

- Flexible Time

- Payment in the bulk

- Receive Bukti Pembayaran Negara (BPN) in real time

Information

More detailed information about Penerimaan Negara (MPN)

Please contact Hello Danamon at 1-500-090 or email

hellodanamon@danamon.co.id

FAQ

Modul Penerimaan Negara is an integrated electronic system for managing state revenue through billing codes so as to make it easier for taxpayers, payers, and depositors so that all deposits can be applied more practically, quickly, and safely through the payment channels provided by the Bank.

- Dirjen Pajak Billing Code (Setoran Pajak Persepsi)

• ThroughDanamon Cash Connect. Link: https://cashconnect.danamon.co.id/

• Through Dirjen Pajak Website. Link: https://sse.pajak.go.id/

- Dirjen Bea dan Cukai Billing Code (Setoran Pajak Ekspor dan Impor)

• Link: https://customer.beacukai.go.id/

- Dirjen Anggaran Billing Code (Setoran PNBP)

• Link: https://simponi.kemenkeu.go.id/index.php/welcome/login

The payment of Modul Penerimaan Negara can be performed at Danamon Branch Offices (Teller) and Danamon Cash Connect Services

- Setoran Pajak Persepsi

In this category, you can pay all taxes that are under the auspices of Direktorat Jenderal Pajak, such as Pajak Penghasilan (PPh), PPh 21, PPh 22, PPh 23, PPh 25, PPh 26, PPh 29, PPh Final

- Setoran Pajak Ekspor and Impor

In this category, you can pay biaya customs / beacukai (under the auspices of Direktorat Jenderal Bea Cukai)

- Bayar Penerimaan Negara Bukan Pajak (PNBP)

In this category, you can pay fees/taxes that are under the auspices of Direktorat Jenderal Anggaran, such as passport and SIM extension fees

- Menu Tax Payment -> Single Billing

- Especially for create a bulk ID Billing, Tax Payment Menu -> Multibilling

If you don’t have the menu, contact the Transaction Banking Implementation Team (email: tb.implementation@danamon.co.id).

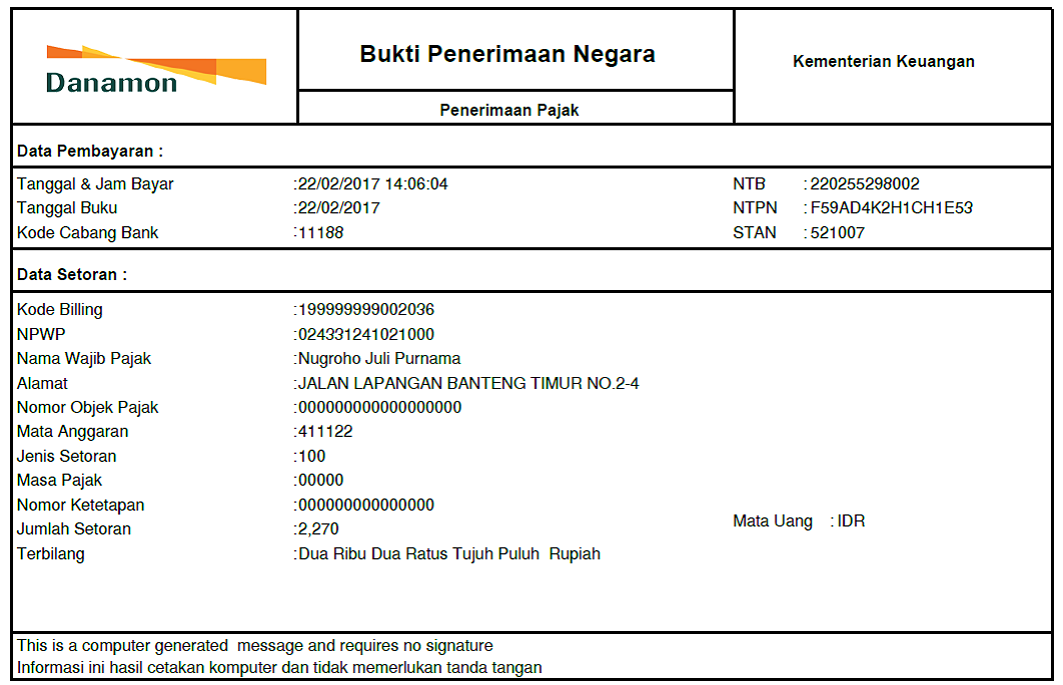

The averment that the payment of Modul Penerimaan Negara has been successful, if your account has been debited for the transaction successfully and Bukti Penerimaan Negara (BPN) can be printed. You can generate the Bukti Penerimaan Negara on BPN Report menu.

Note: Always check whether the account has been debited after you have done the transaction of Modul Penerimaan Negara. If the account has been debited but you don’t receive BPN/NTPN or get a timeout response, don’t do any repeat transaction, immediately contact Transaction Banking Service (email: tb.service@danamon.co.id)

For reference steps information to get a billing code, please click here

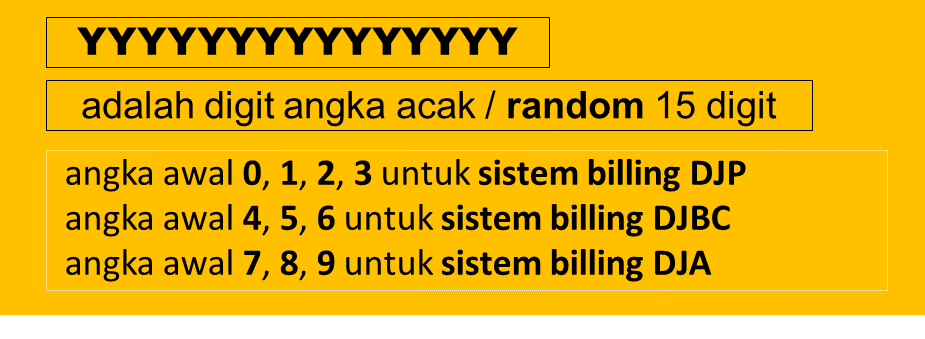

Billing Code Format:

Billing Code is an identification code issued by the billing system for a type of payment or deposit to be made by a taxpayer/payer/compulsory deposit in the context of identifying the billing code issuer in Modul Penerimaan Negara. Consists of 15 digit numbers, where the first digit is the billing issuer code.

Example of Billing Code Format is shown as follows:

If your transaction has been processed successfully, you will received Bukti Penerimaan Negara as a transaction proof.

Example of Bukti Penerimaan Negara is shown as follows:

Yes, the validity period of payment code/billing code for Setoran Pajak Persepsi is 30 days. While the validity period of the payment code/billing code for Pajak Export dan Import and Penerimaan Negara Bukan Pajak (PNBP) follows the applied general terms.

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service