-

Personal

Personal

-

Business

Business

-

E-Banking

E-Banking

- Career

-

About Danamon

About Danamon

Dual Currency Investment (DCI) is a product of PT Bank Danamon

Indonesia Tbk (“Bank”) in the form of structured product which offered by the Bank exclusively to

Customers.

• DCI is short term investment and suitable for any customer’s risk preferences.

• DCI has the primary function of yield enhancement. Investors can also use it as a currency management

tool to achieve portfolio diversification.

Features

• DCI is available in Rupiah and 8 (eight) foreign currencies, with more than 21 (twenty-one) foreign

currency pairs possibilities.

• Potential return is higher than conventional foreign currency time deposit.

• Flexibility to determine the currency pairs with agreed strike price at value date.

• Fix return, with principal return in base currency or alternate currency based on the foreign exchange

performance on fixing date and time.

• Alternative for short term investment, start from 1 (one) week.

• European Style option type where placement result determined on fixing date and time.

You can invest in DCI if you:

Illustration

Illustration for DCI Valas – Rupiah

Customer investing in DCI with following details:

| DCI Placement | : USD 100,000 |

| Base Currency | : USD |

| Alternate Currency | : IDR |

| Spot in Trade Date USD/IDR | : 14,850 |

| Strike Price | : 14,890 |

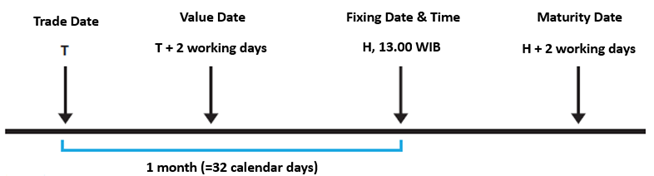

| Tenor | : 1 month (=32 days) |

| Return | : 3% gross per annum |

| Tax | : 20% |

Scenario A

At fixing

date and time, Spot USD/IDR 14,870 → spot at fixing

date and time did not reach the strike price, so that Customer will receive principal and return in USD.

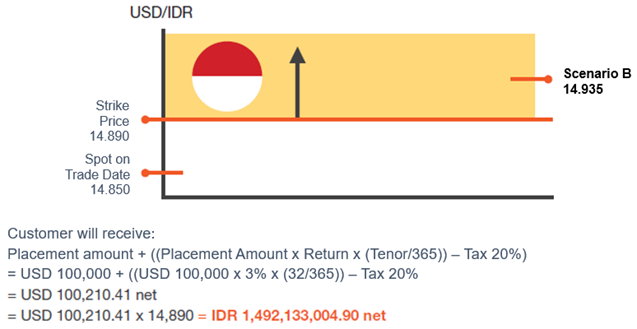

Scenario B

At fixing date and time, Spot USD/IDR 14,935 → spot at fixing

date and time reaches the strike price, so that Customer will receive principal and return in IDR.

If Customer in Scenario B directly convert the DCI result back to base currency (USD), customer will receive USD:

IDR 1,492,133,004.90 / 14,935 = USD 99,908.47

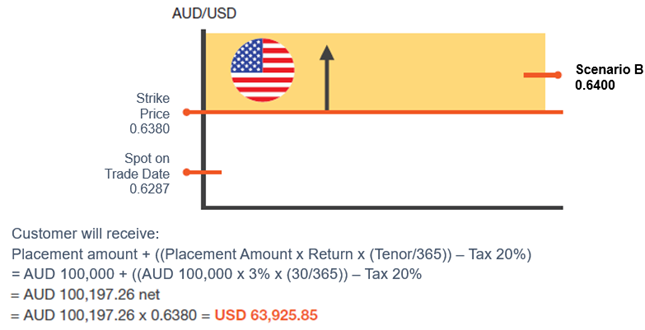

Illustration DCI Valas – Valas

Customer investing in DCI with following details:

| DCI Placement | : AUD 100,000 |

| Base Currency | : AUD |

| Alternate Currency | : USD |

| Spot in Trade Date AUD/USD | : 0.6280/0.6287 |

| Strike Price | : 0.6380 |

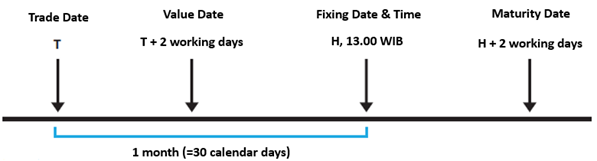

| Tenor | : 1 month (=30 days) |

| Return | : 3% gross per annum |

| Tax | : 20% |

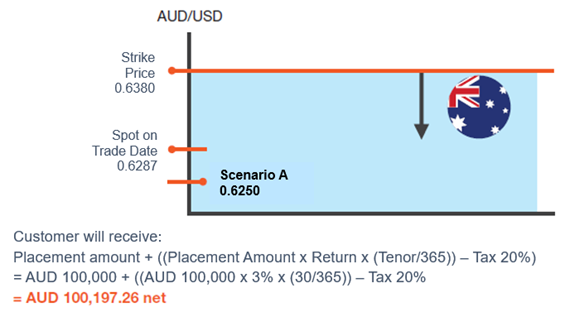

Scenario A

At fixing date and time, Spot AUD/IDR 0.6250 → spot at fixing date and time did not reach the strike price, so that Customer will receive principal and return in USD.

Scenario B

At fixing date and time, Spot AUD/USD 0.6400 → spot at fixing date and time reaches the strike price, so that Customer will receive principal and return in IDR.

If Customer in Scenario B directly convert the DCI result back to base currency (USD), customer will receive USD:

USD 63,925.85 / 0.6400 = AUD 99,884.14

Please download here to see complete information about Dual Currency Investment (DCI)

General terms and conditions for Dual Currency Investment

(DCI) products, please click

here

Disclaimer

DCI is not a conventional product, but a Structured Product that that combines time deposit with derivative

product (options), issued by PT Bank Danamon Indonesia Tbk. DCI is not guaranteed by the Indonesia Deposit

Insurance Corporation (IDIC). Customer must carefully consider whether the use of DCI is in accordance with the

investment objectives, financial resources, and risk profile of the Customer. Customers are advised to obtain

input from independent parties who are experts in their fields if Customer needs financial or legal advice

regarding the use of DCI. DCI contains risks that can cause some loss in the principal amount of DCI because it

depends on the volatility of currency exchange rates, including at the time of conversion of Alternative

Currency to Base Currency.

Early termination before maturity of DCI is not permitted. If the Customer insist to apply for early

termination, the customer will be charged an early termination fee determined by the Bank.