-

Personal

Personal

-

Business

Business

-

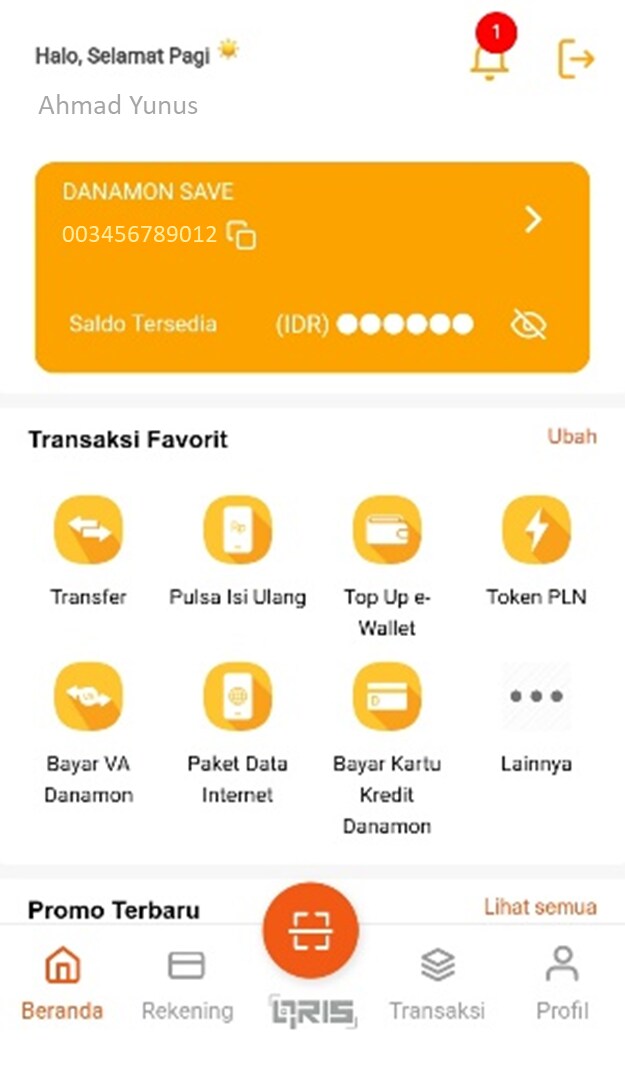

E-Banking

E-Banking

- Career

-

About Danamon

About Danamon

|

Summarized Data |

|

|

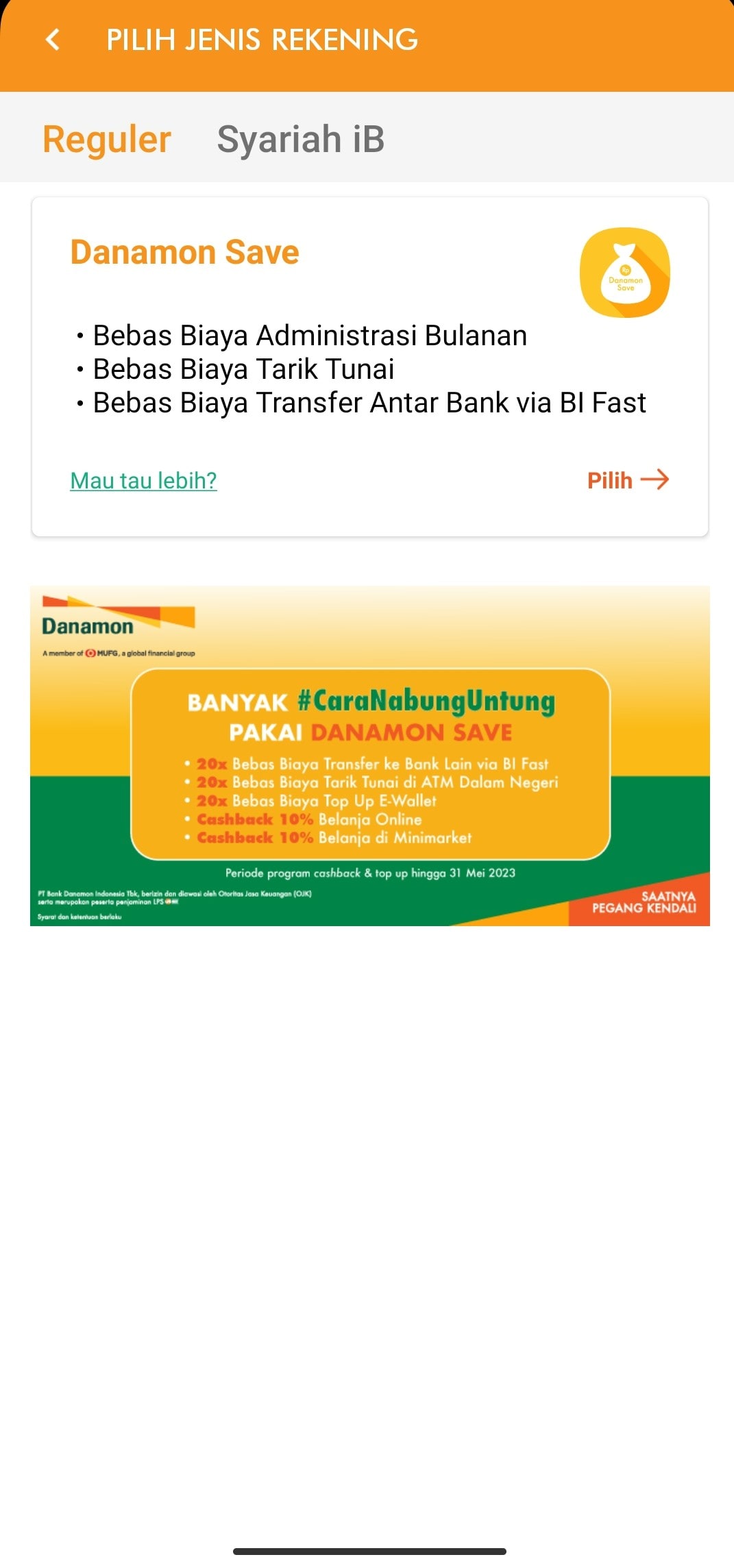

Product Name |

D-Bank Registration |

|

Product Type |

Online Banking Services |

|

Name of Issuer |

PT Bank Danamon Indonesia Tbk |

|

Product Description |

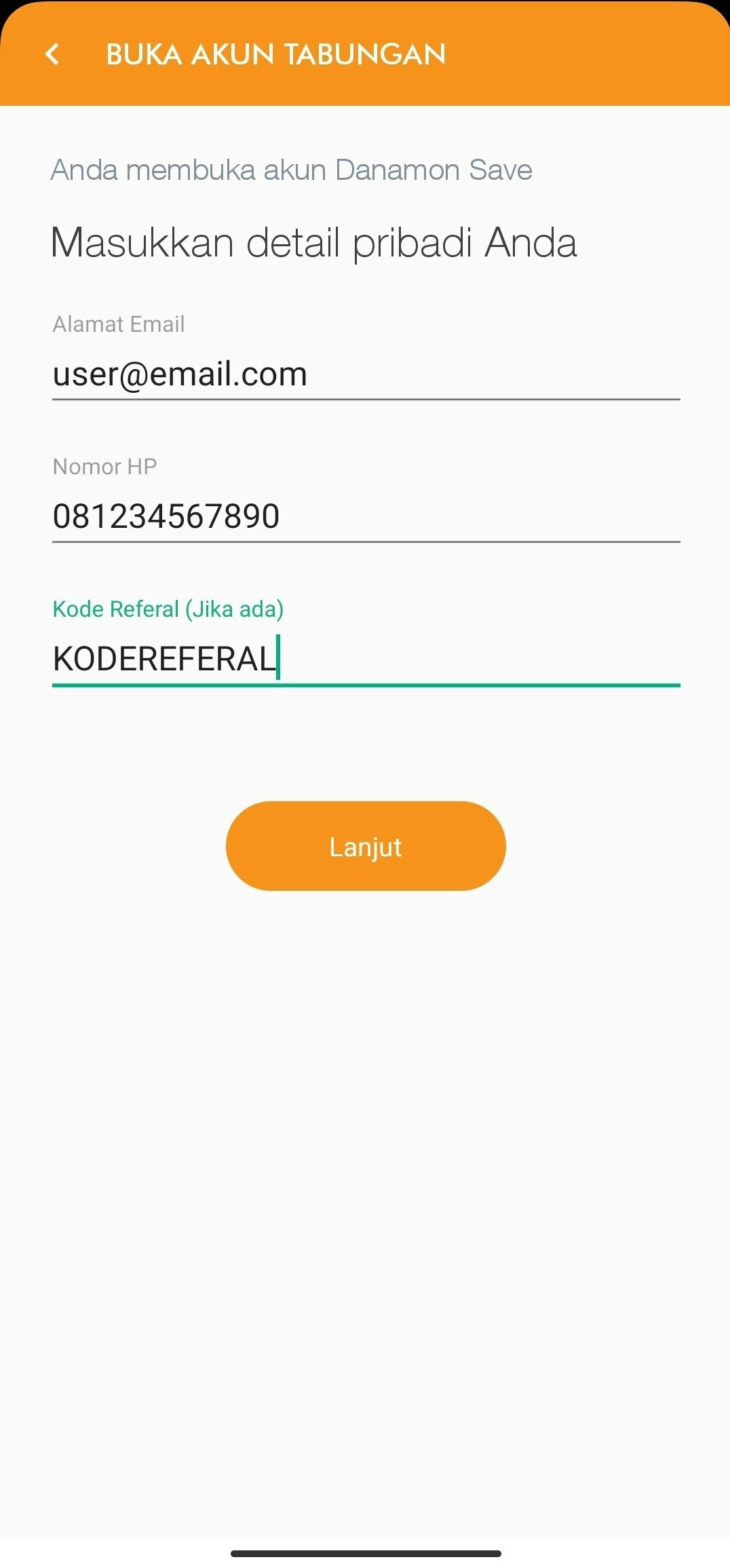

D-Bank Registration is a service from PT Bank Danamon Indonesia Tbk ("Danamon") for prospective new customers to open Danamon accounts online. D-Bank Registration can be accessed using smartphones with Android, iOS, and Web browser operating systems. |

|

Feature |

Mobile Platform (Android/iOS) |

Web Platform |

|

Account Opening |

V |

V |

|

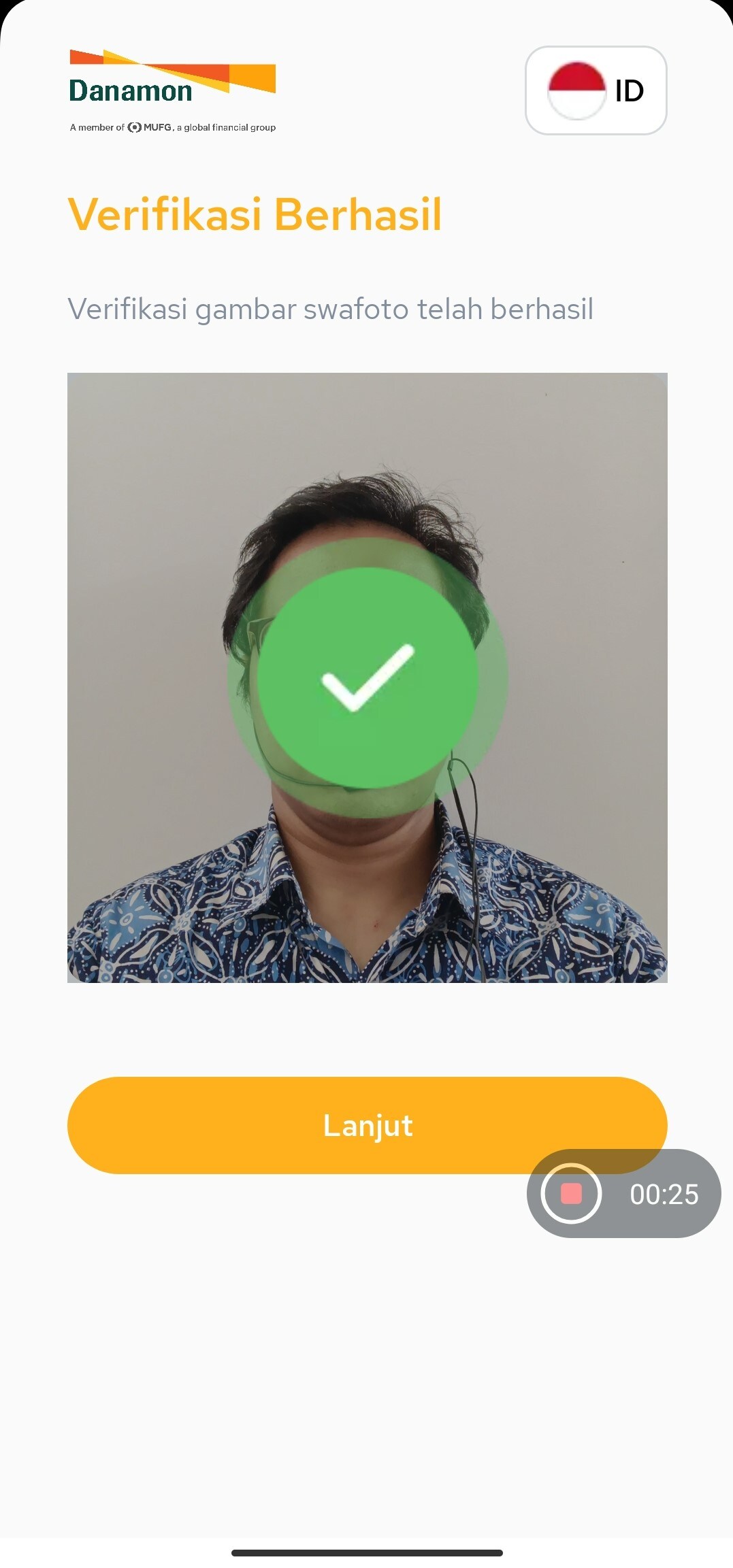

Account Opening Verification |

Face Verification, Video Call, Branch |

Video Call, Branch |

|

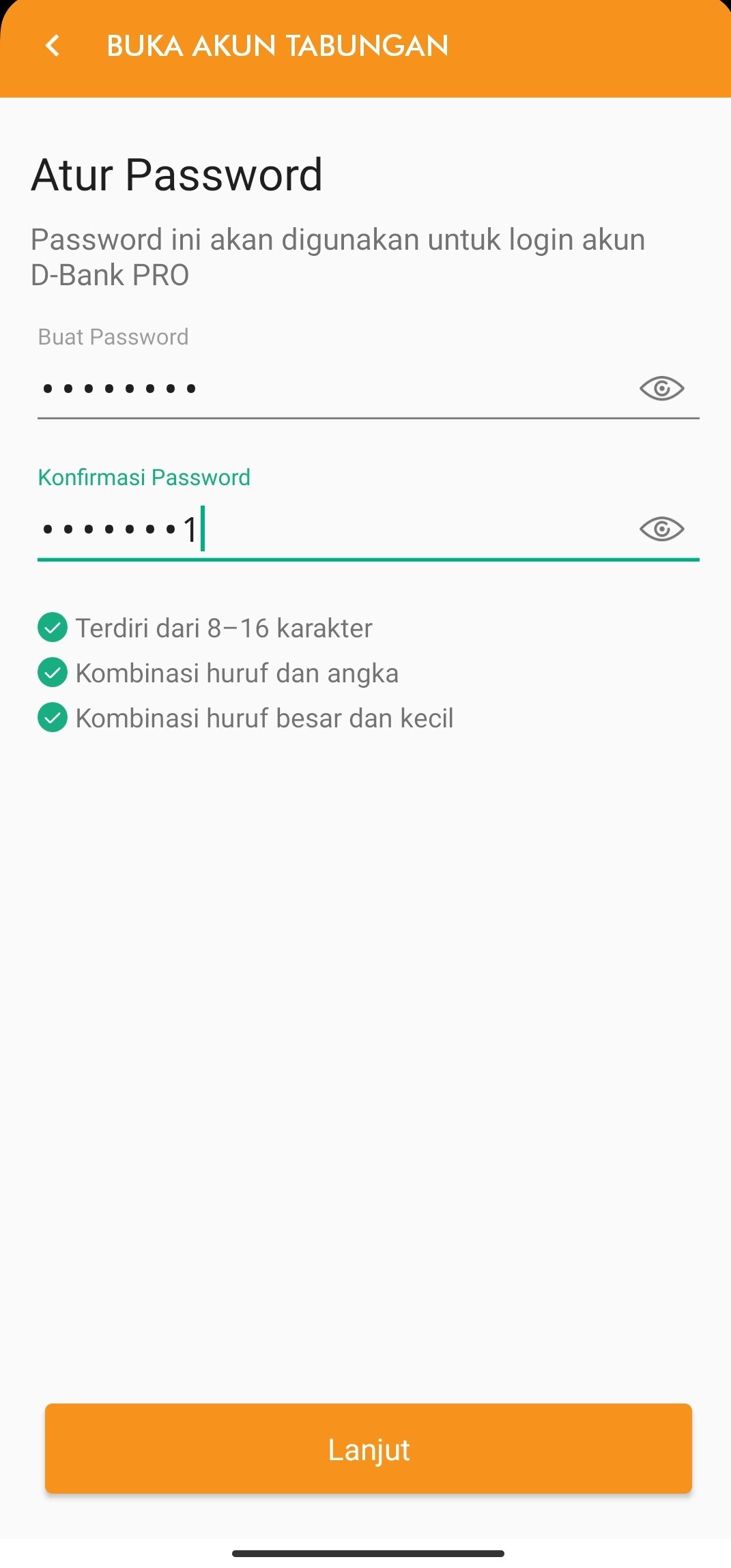

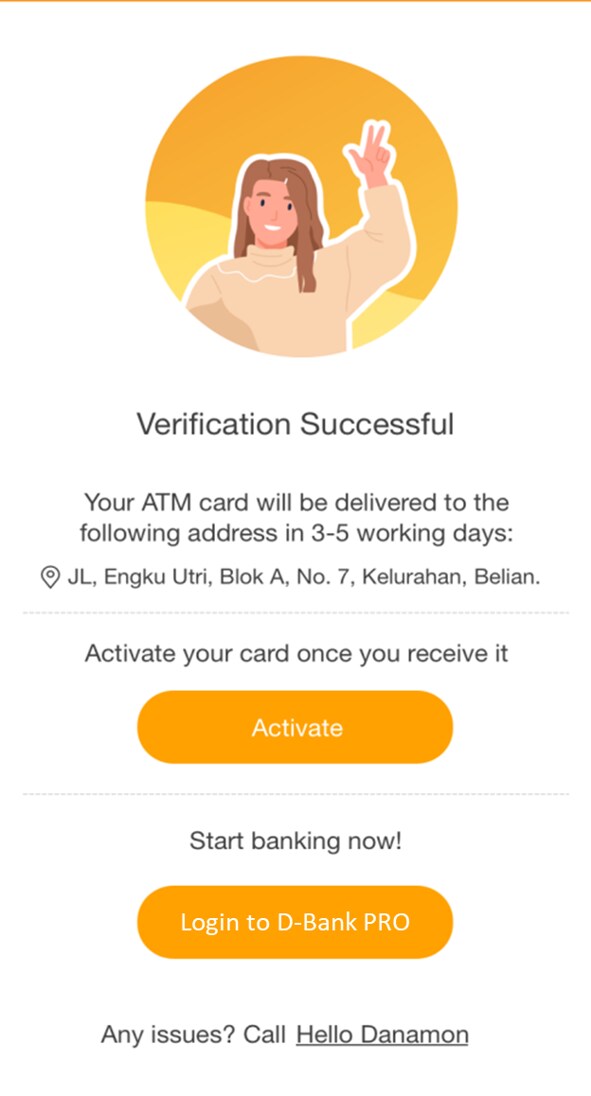

D-Bank PRO Registration |

V |

V |

|

Debit Card Activiation |

V |

V |

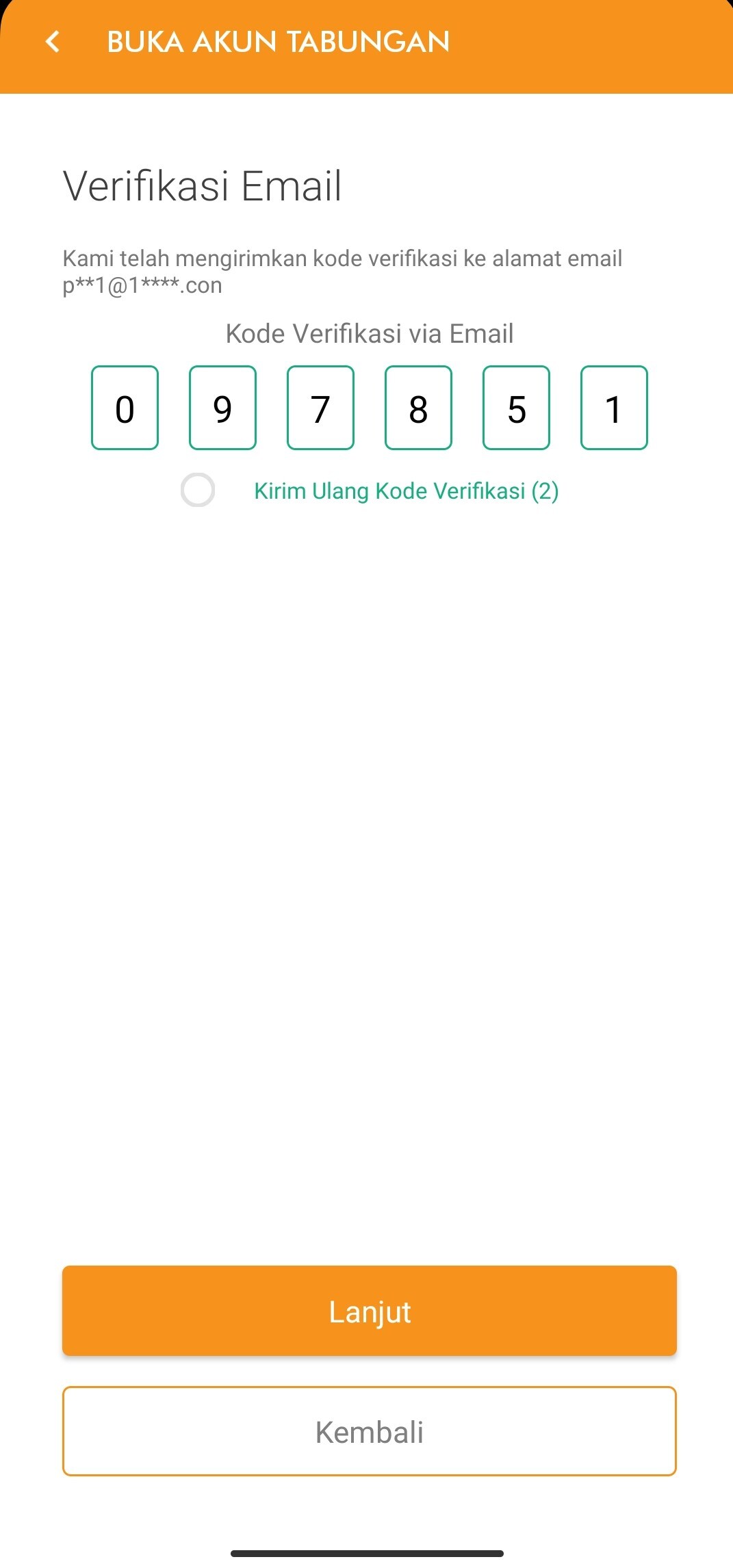

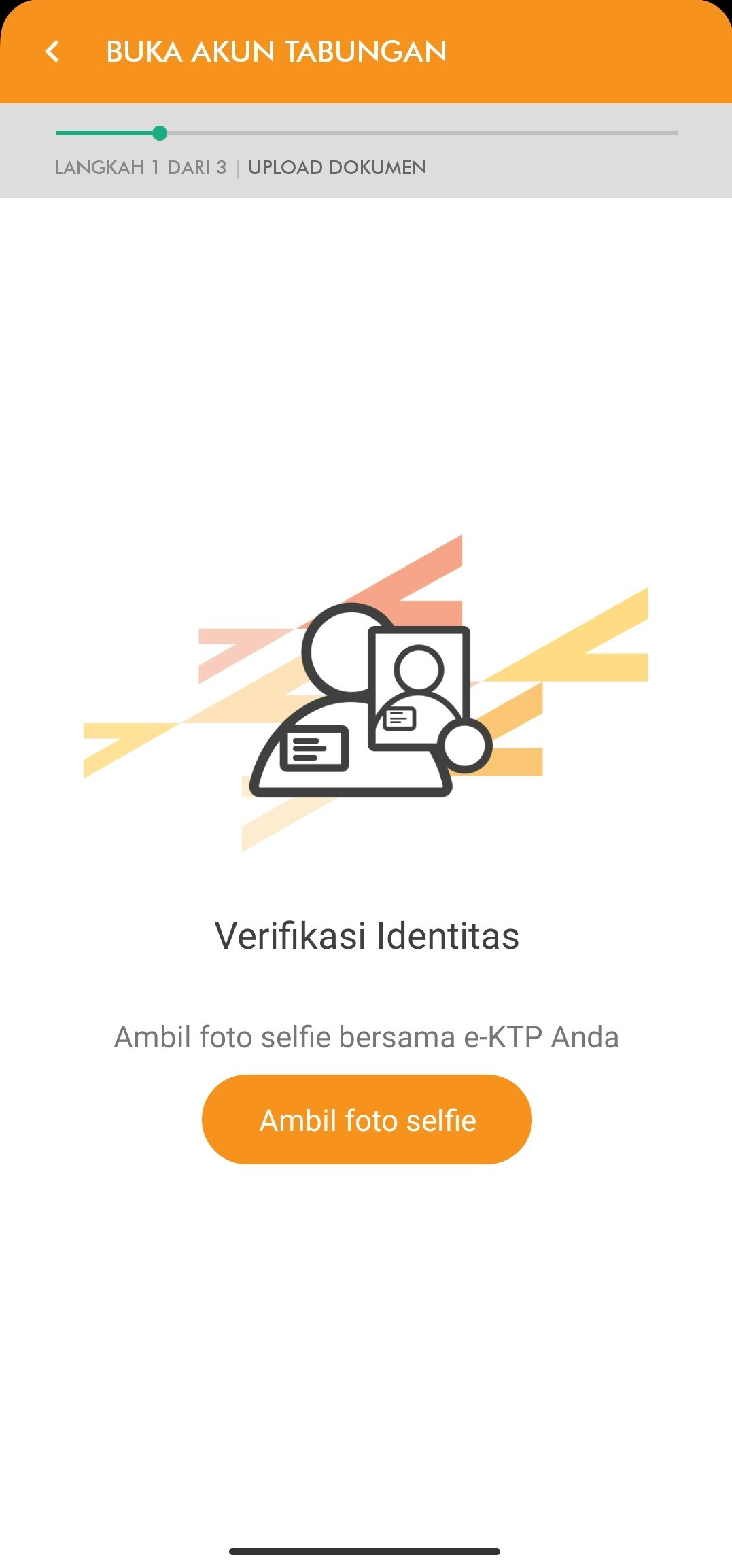

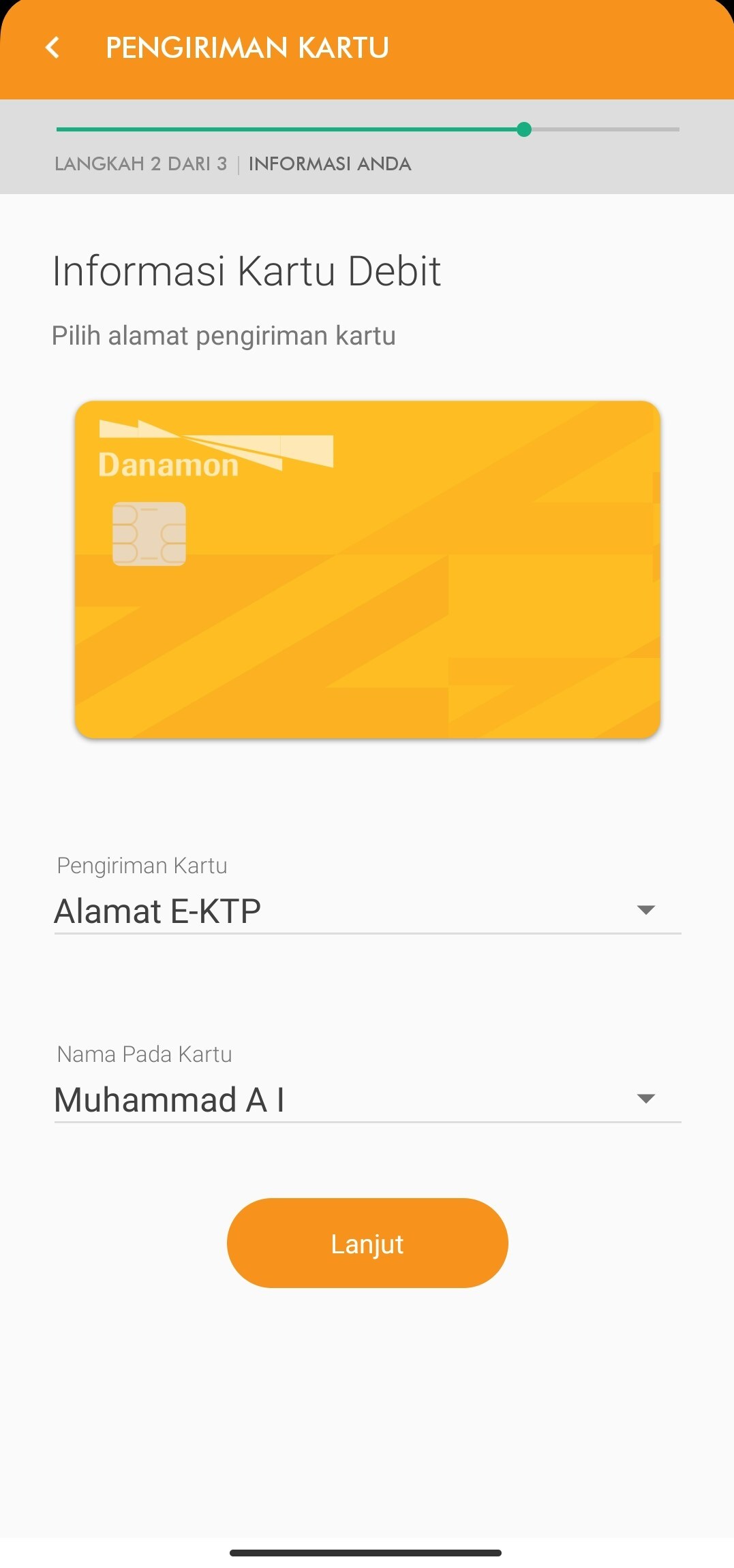

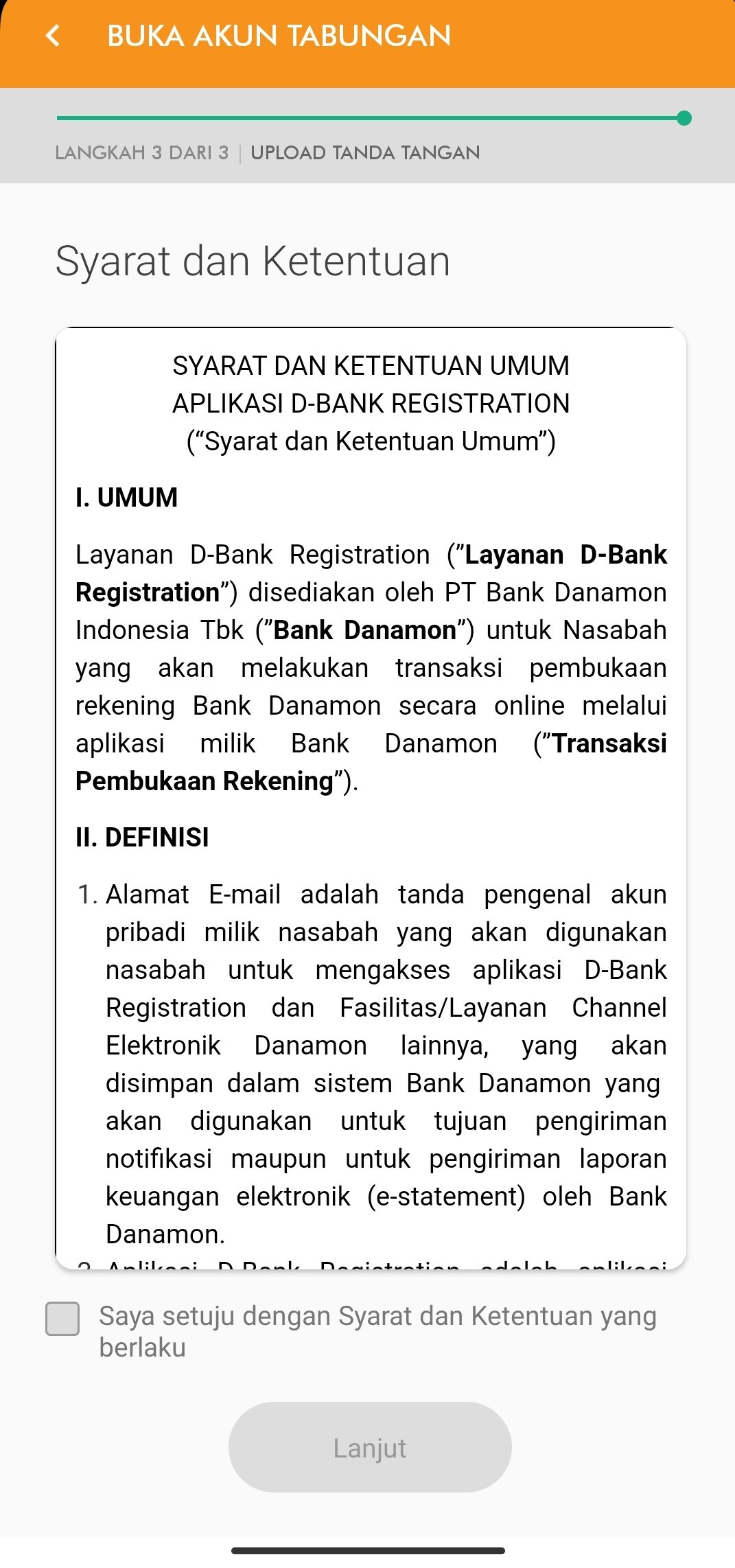

Opening an account can be done with the following steps,

|

Balance before transaction |

Number of Cash Withdrawal Transaction/ transfer via BI Fast |

Transaction Fee |

|

Rp1.000.000 |

10 (< 20) |

No Fee |

|

Rp1.000.000 |

25 (> 20) |

Fees Apply |

|

Rp900.000 |

10 (< 20) |

Fees Apply |

|

Rp900.000 |

25 (> 20) |

Fees Apply |

|

Saldo sebelum transaksi |

Transaksi Tarik Tunai ke-/ transfer via BI Fast ke- |

Biaya transaksi |

|

Rp1.000.000 |

10 (< 20) |

Tidak dikenakan biaya |

|

Rp1.000.000 |

25 (> 20) |

Dikenakan biaya |

|

Rp900.000 |

10 (< 20) |

Dikenakan biaya |

|

Rp900.000 |

25 (> 20) |

Dikenakan biaya |

Scan to open Danamon savings account

PT Bank Danamon Danamon Indonesia Tbk is an LPS insured participant, licensed and supervised by the Financial Services Authority (OJK).