Product Information

Rekening Tabungan Jemaah Haji (RTJH)

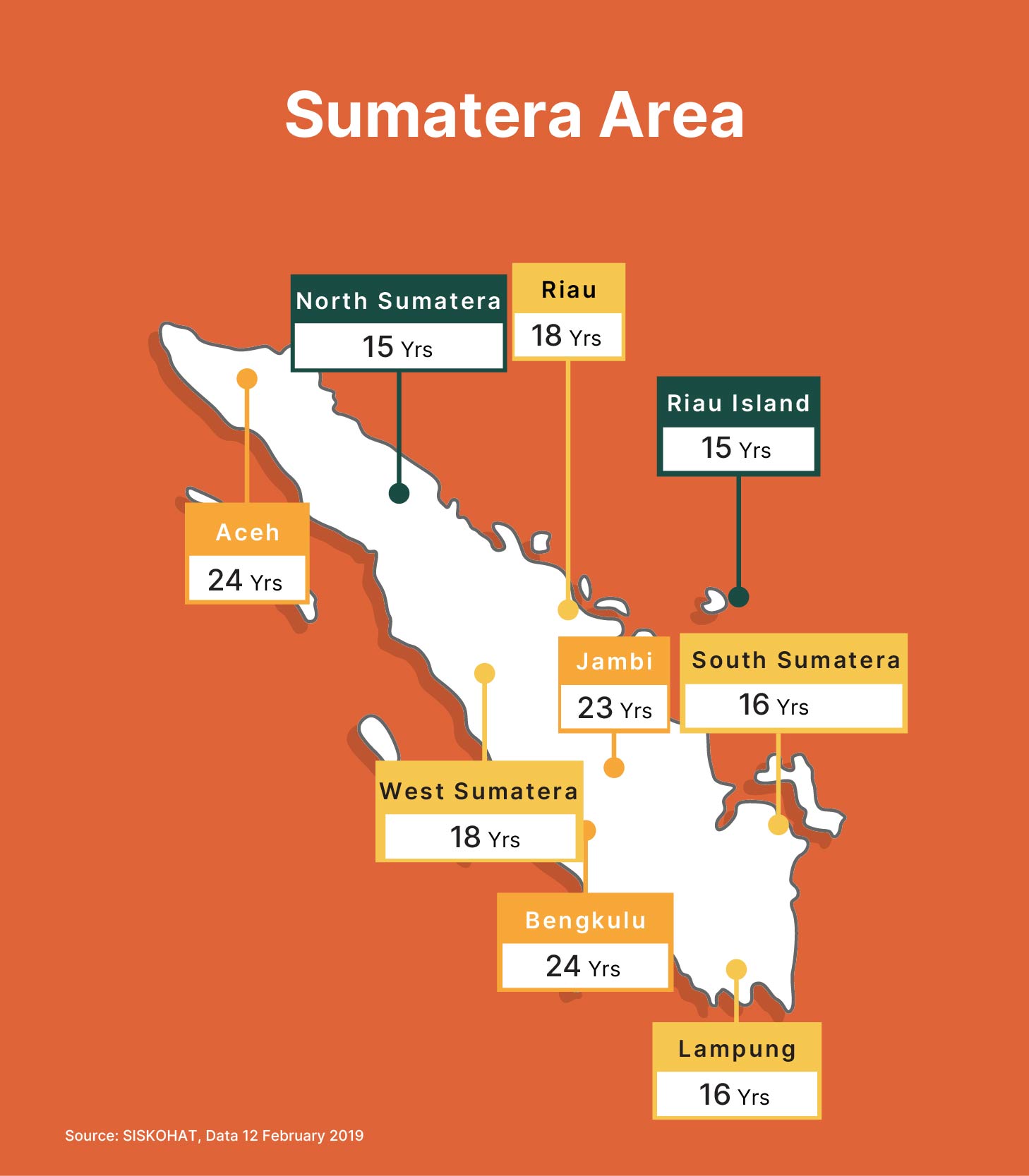

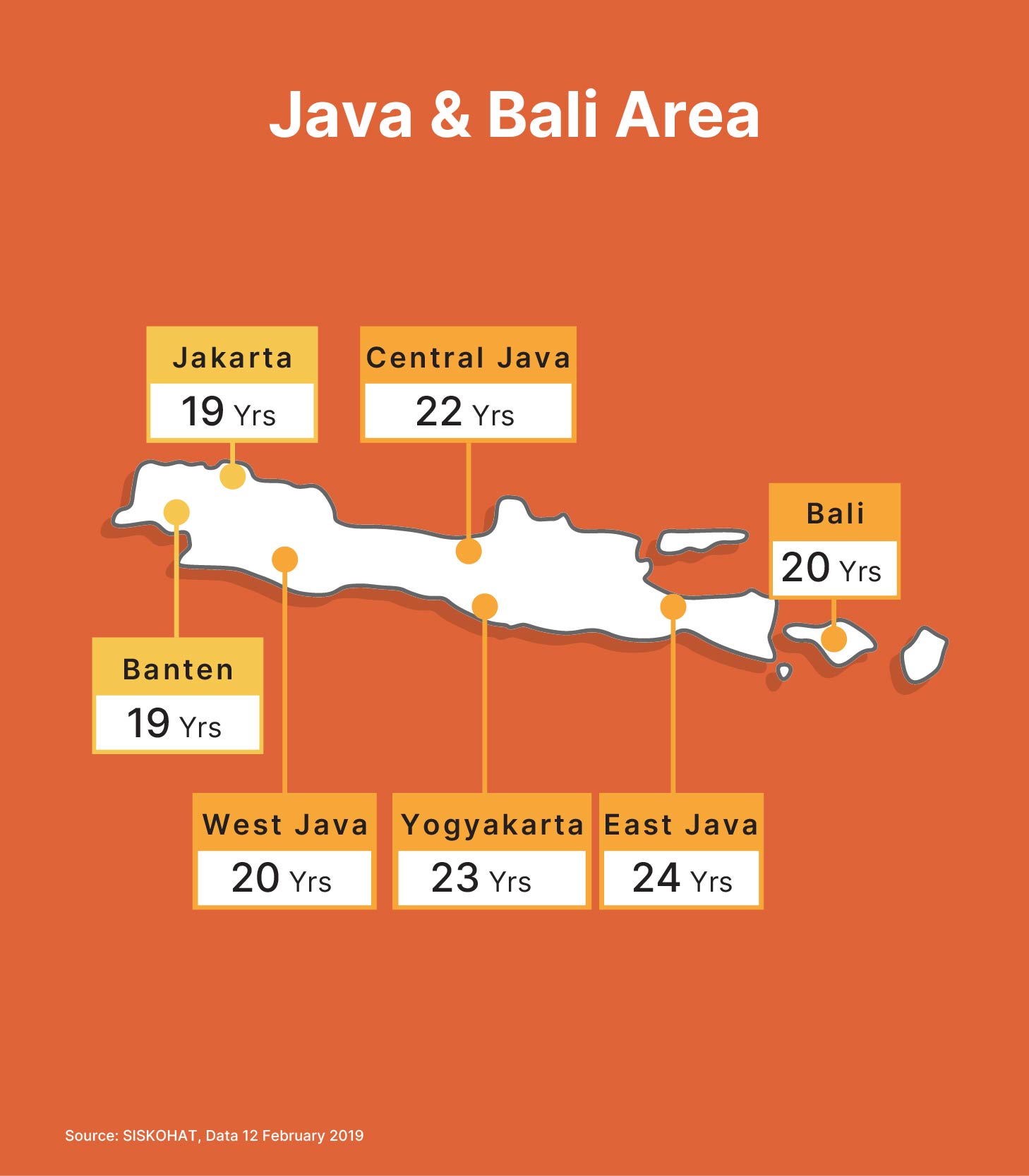

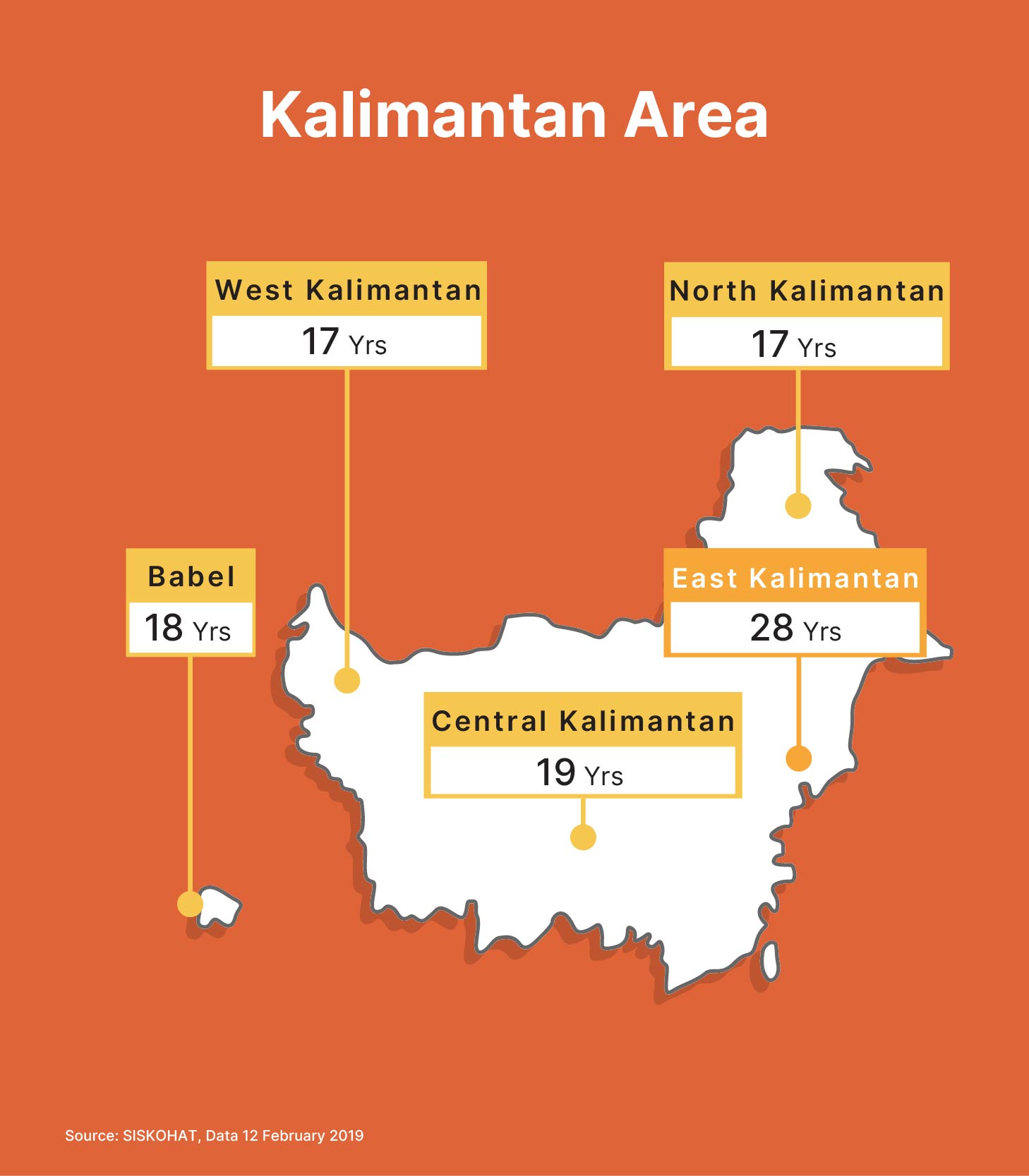

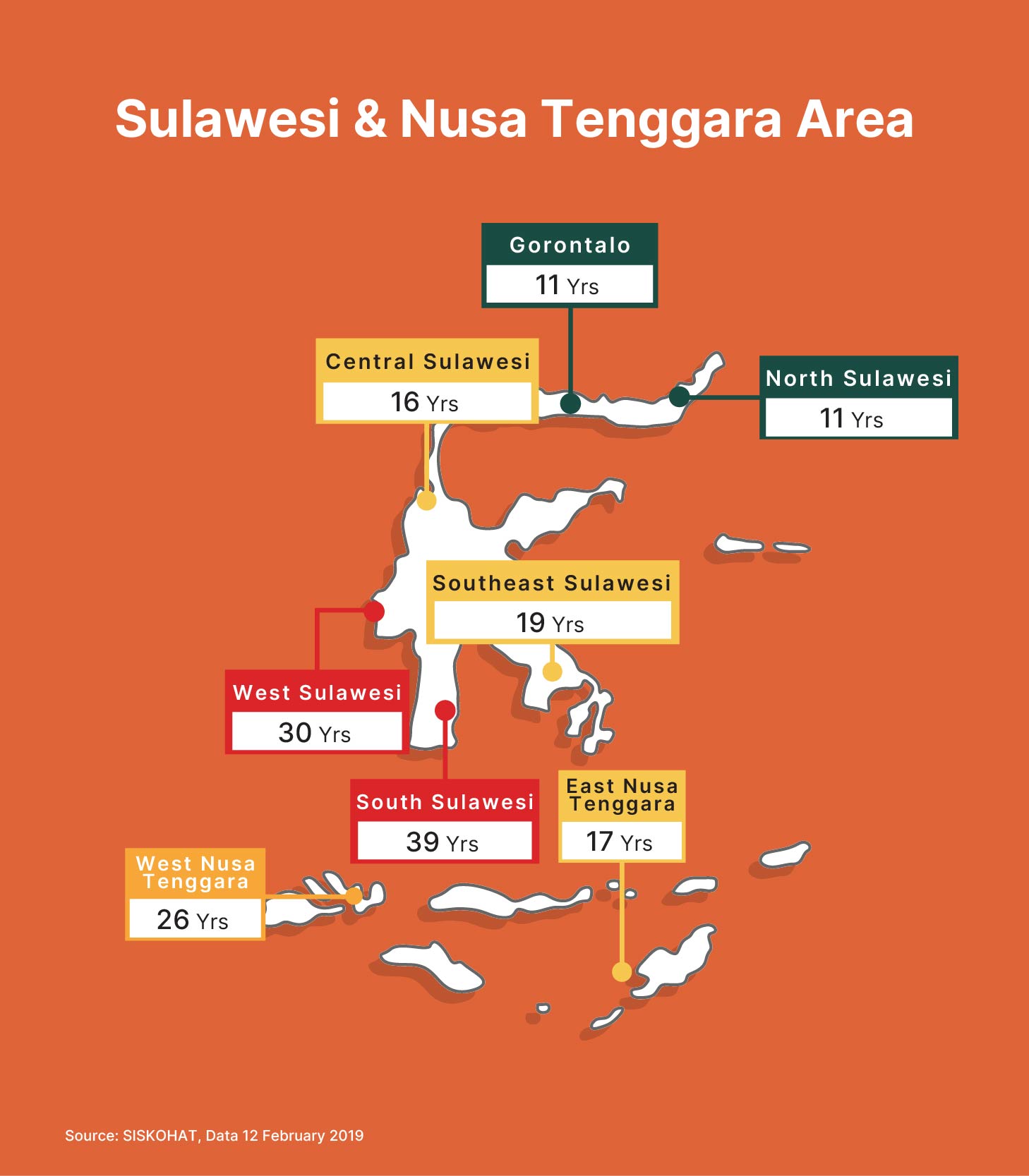

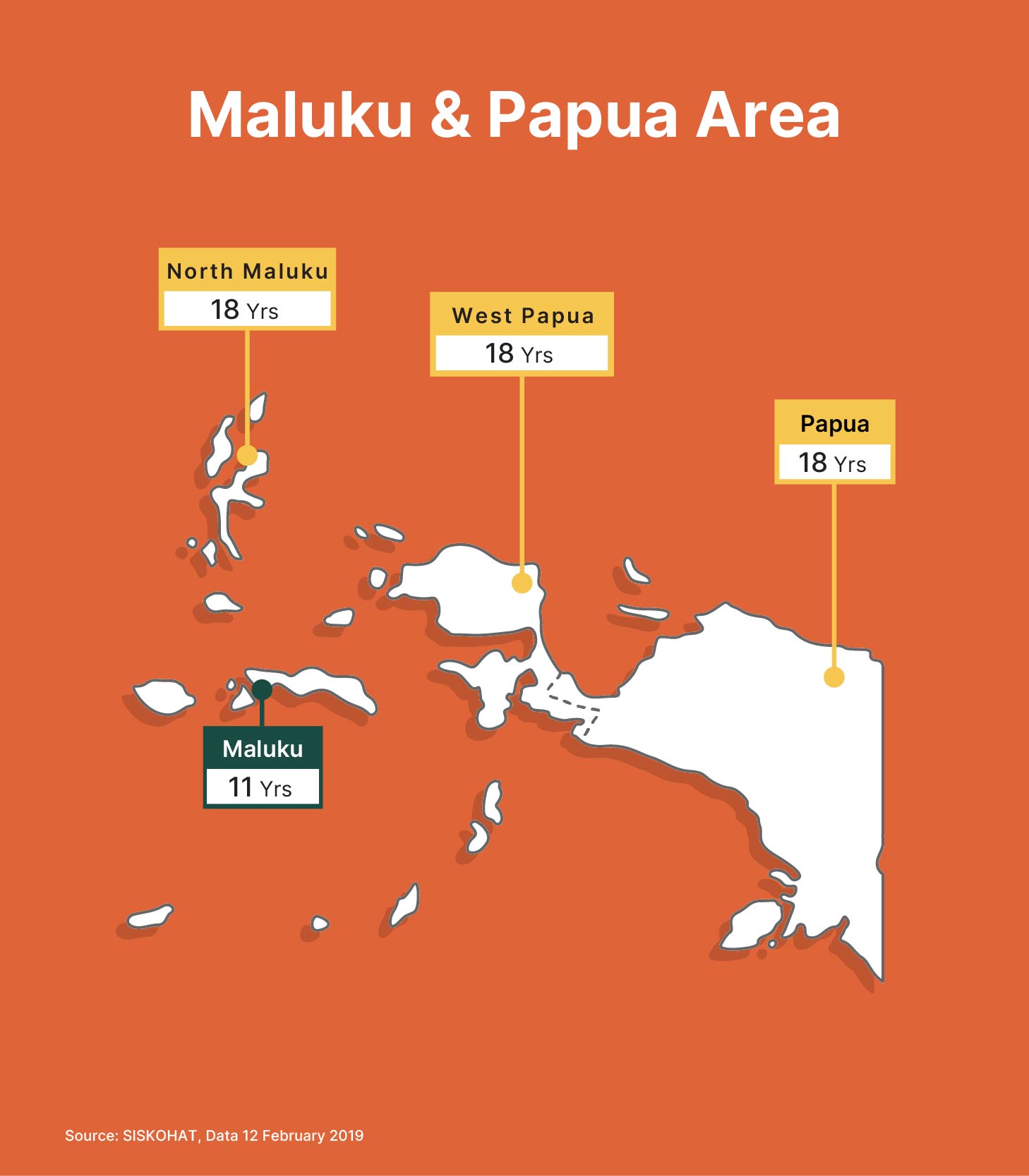

Rekening Tabungan Jemaah Haji (RTJH) makes it easy for customers to register for the Hajj pilgrimage by paying an initial deposit for the Hajj Pilgrimage Travel Costs (Bipih – Biaya Perjalanan Ibadah Haji), which is directly connected to the Sistem Komputerisasi Haji Terpadu (SISKOHAT) of the Indonesian Ministry of Religious Affairs.

Contract

Deposit (Wadiah)

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service