Pilihan investasi dengan kupon/imbalan secara regular dan potensi keuntungan pokok.

Persyaratan Transaksi Obligasi

- Memiliki rekening CASA di Bank Danamon

- Memiliki profil risiko yang masih aktif

- Memiliki dana yang cukup di rekening CASA sebelum melakukan transaksi Obligasi ini

- Memiliki SID untuk Obligasi yang terdaftar di Bank Danamon

- Mengisi dan melengkapi dokumen-dokumen yang diperlukan untuk transaksi obligasi

Perpajakan:

|

Imbal

hasil/Kupon

yang

diterima Nasabah |

10% |

| Keuntungan diterima atas Obligasi yang dimiliki Nasabah | 10% |

- Bank Danamon hanya bertindak sebagai Agen Penjual produk Obligasi. Obligasi BUKAN merupakan produk Bank Danamon sehingga tidak dijamin oleh Bank Danamon, BUKAN merupakan bagian dari simpanan Nasabah pada Bank Danamon sehingga tidak termasuk dalam cakupan obyek program penjaminan Lembaga Penjamin Simpanan (LPS).

- Investasi pada produk Obligasi mengandung risiko investasi yang memungkinkan Nasabah kehilangan sebagian atau seluruh modal yang diinvestasikan. Setiap pilihan atas produk Obligasi yang dibeli Nasabah merupakan keputusan dan tanggung jawab Nasabah sepenuhnya, termasuk apabila Nasabah memilih jenis produk yang tidak sesuai dengan profil risiko Nasabah dan oleh karenanya Bank Danamon tidak memiliki kewajiban apapun atas kerugian, penurunan investasi tersebut, ketidak tersedianya atau pengurangan dana sehubungan dengan investasi tersebut. Demikian pula segala risiko yang timbul sebagaimana dijabarkan dalam Ringkasan Informasi Produk ini akan menjadi tanggung jawab Nasabah..

- Sebelum membeli produk Obligasi, Nasabah wajib membaca dan memahami Ringkasan Informasi Produk.

- Proses verifikasi dan persetujuan pembukaan produk merupakan wewenang Bank Danamon sepenuhnya.

- Ketentuan lain yang terkait dengan produk dan/atau layanan, sepanjang tidak diatur berbeda dalam Syarat dan Ketentuan Umum ini dinyatakan tetap berlaku dan mengikat Nasabah.

- Nasabah dengan ini setuju dan mengakui bahwa Bank Danamon berhak untuk memperbaiki/mengubah/melengkapi Syarat dan Ketentuan Umum ini (selanjutnya disebut “Perubahan“).

- Bank Danamon akan menginformasikan setiap perubahan manfaat, biaya, risiko dan Syarat dan ketentuan ini kepada Nasabah melalui media komunikasi yang tersedia pada Bank Danamon dan dalam hal Nasabah tidak setuju dengan adanya perubahan tersebut, maka Nasabah dapat mengirimkan pernyataan keberatannya kepada Bank Danamon dalam waktu 30 (tiga puluh) hari kerja terhitung sejak perubahan dikirimkan/diumumkan melalui media komunikasi yang tersedia pada Bank Danamon. Dalam hal Nasabah bermaksud mengakhiri/menutup produk dan/atau layanan yang telah diperoleh, maka Nasabah wajib menyelesaikan seluruh kewajibannya terlebih dahulu. Dengan lewatnya waktu tersebut di atas, Nasabah setuju bahwa Bank Danamon akan menganggap Nasabah menyetujui perubahan tersebut

- Nasabah dapat mengajukan pengaduan atas transaksi/layanan perbankan melalui kantor cabang Bank Danamon yang terdekat atau Hello Danamon (1-500-090) atau melalui email di hellodanamon@danamon.co.id secara lisan maupun secara tertulis.

- Nasabah dapat mengajukan pengaduan/keluhan mengenai Obligasi dengan mengemukakan alasannya secara lisan dan/atau tertulis melalui media komunikasi yang dikelola secara resmi oleh Bank Danamon. Mekanisme dan tata cara pengajuan pengaduan/keluhan dapat diakses melalui https://www.danamon.co.id.

- Prosedur mengenai layanan Pengaduan Nasabah dapat diakses melalui website https://www.danamon.co.id

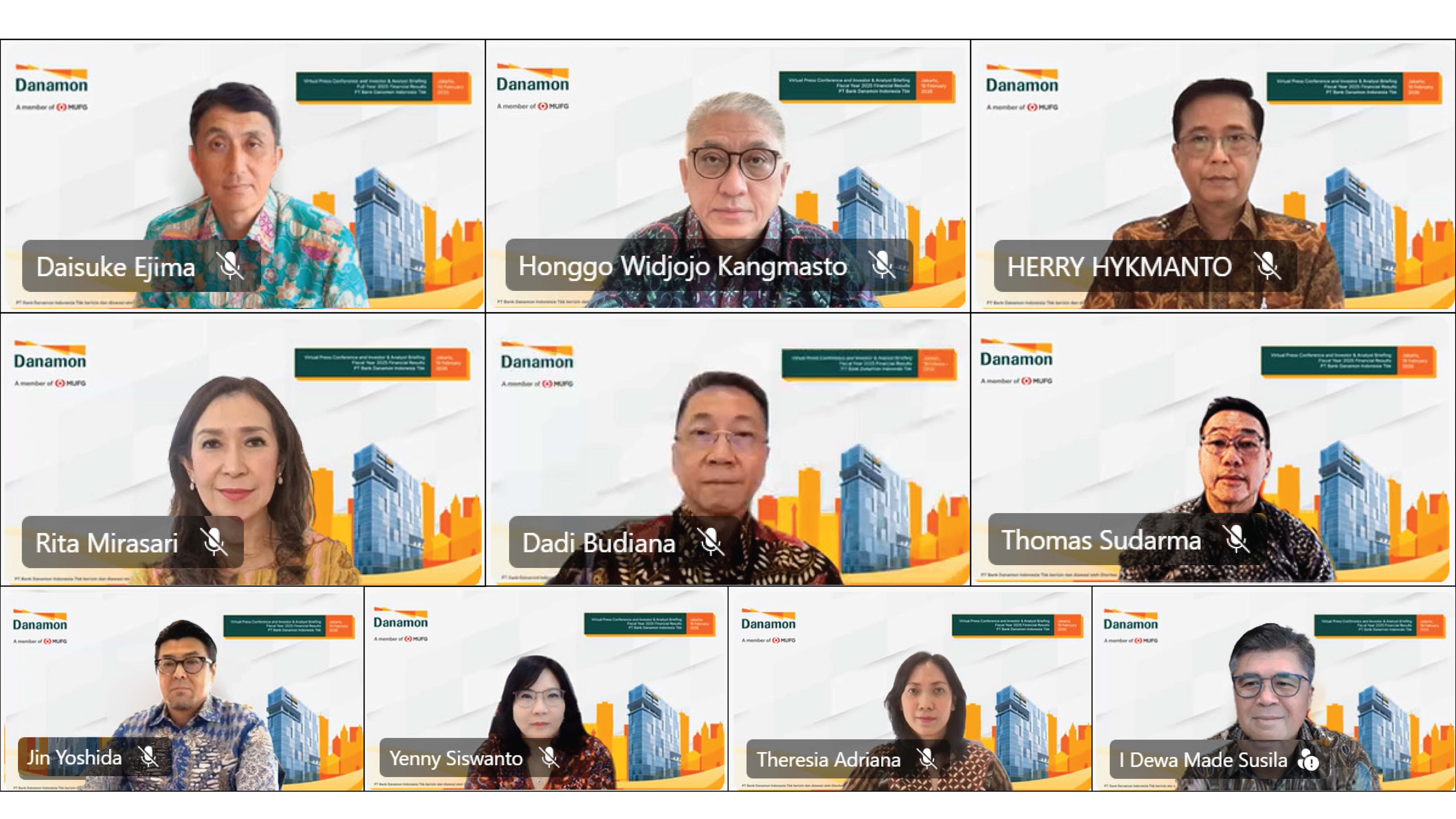

- PT. Bank Danamon Indonesia, Tbk merupakan peserta penjaminan Lembaga Penjamin Simpanan (LPS), terdaftar dan diawasi oleh OJK dan Bank Indonesia. Syarat dan Ketentuan Umum ini telah disesuaikan dengan ketentuan peraturan perundang-undangan termasuk ketentuan peraturan Otoritas Jasa Keuangan.

Hubungi Kami

Hubungi Kami

Lokasi Kami

Lokasi Kami

E-Form

E-Form

Layanan Whistleblower

Layanan Whistleblower