Program Description

These General Terms and Conditions of the Program (“General Terms and Conditions of the Program”) are the terms and conditions that apply to Customers who participate in the New FX D-Bank PRO Program (“Program”) organized by PT Bank Danamon Indonesia Tbk (“Bank Danamon”).

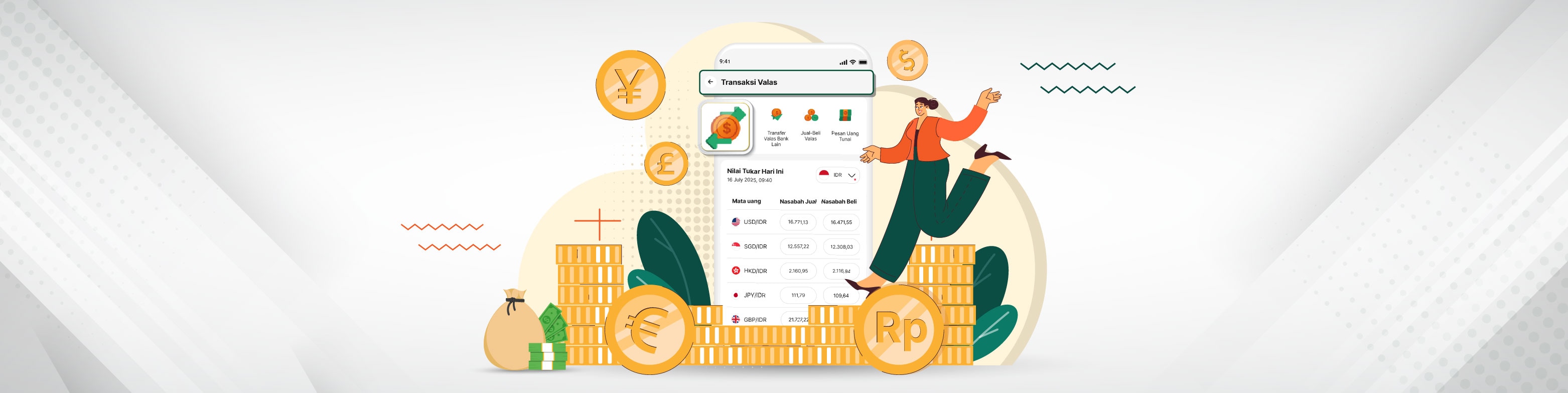

This program is held for customers according to the Participant Criteria who can conduct foreign exchange transactions at D-Bank PRO (“Customers”) at a certain exchange rate within a certain time period determined according to the General Terms and Conditions of the Program.

The Customer hereby agrees and is bound by all provisions in the General Terms and Conditions of the Program as follows:

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service