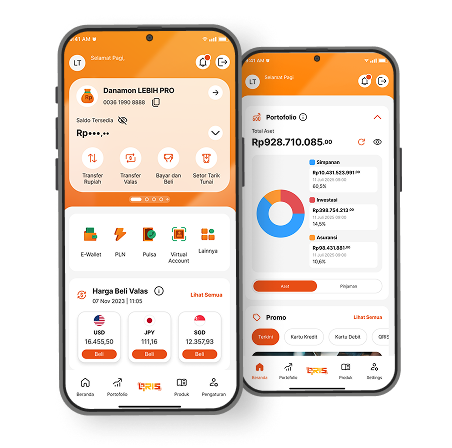

Program Description

The Program General Terms and Conditions Save 5% + 0% Installment at Altius Hospitals (“Progam General Terms and Conditions”) constitute the terms and conditions applicable to Program Participant of Save 5% + 0% Installment at Altius Hospitals ("Program") organized by PT Bank Danamon Indonesia Tbk ("Bank") in collaboration with PT Dian Langgeng Permata (“Altius Hospitals”).

The Program Participant hereby agrees to and is bound by all provisions set forth in the following Program General Terms and Conditions:

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service