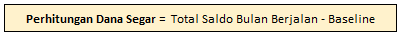

Program Description

GENERAL TERMS AND CONDITIONS OF THE 2025 TELESALES CHANNEL BALANCE TOP-UP PROGRAM

General Terms and Conditions of the Telesales Channel Balance Top-Up Program (“General Terms and Conditions of the Program”) are the terms and conditions applicable to Customers participating in the Telesales Channel Balance Top-Up program (“Program”) organised by PT Bank Danamon Indonesia Tbk (“Bank Danamon”).

Customers hereby agree and bind themselves to all provisions in the General Terms and Conditions of the Program as follows:

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service