Informasi Produk

Produk Asuransi Jiwa yang memberikan Manfaat Perlindungan jangka panjang untuk mempersiapkan dana masa depan.

Menu Cepat

Menu Cepat

IDR

IDR

IDR

IDR

USD

USD

EUR

EUR

IDR

IDR

IDR

IDR

USD

USD

EUR

EUR

| Tabel | |

|---|---|

| Tujuan Investasi | Investasi Masa Depan |

| Komparasi Jenis Aset Konvensional | Deposito |

| Komparasi Jenis Aset Investasi | |

| Nominal Investasi Awal | 0,00 |

| Nominal Investasi Bulanan | 0,00 |

| Deposito | |

|---|---|

|

Total Tabungan + Keuntungan

71.228.531,00

|

Total Tabungan + Keuntungan

78.729.940,72

|

|

Total Tabungan

70.000.000,00

|

Total Tabungan

70.000.000,00

|

|

Total Keuntungan

1.228.531,00

|

Total Keuntungan

8.729.940,72

|

|

Nilai Pertumbuhan %

1,76%

|

Nilai Pertumbuhan %

12,47%

|

|

Jangka Waktu Investasi

20 Tahun

|

Jangka Waktu Investasi

20 Tahun

|

| Hasil Simulasi Anda | |

|---|---|

| Harga Properti | 0,00 |

| Uang Muka | 0,00 |

| Jangka Waktu Investasi | 1 Tahunan |

| Suku Bunga per Tahun (%) | 0% |

| Jumlah Pinjaman Anda | 0,00 |

| Angsuran Per Bulan Anda | 0,00 |

| Hasil Simulasi : | |

|---|---|

| Nominal Pinjaman Anda | 0,00 |

| Bulanan | 1 Bulan Bulan |

| Suku Bunga Pinjaman per Bulan (%) | 0% |

| Total Cicilan anda per Bulan | 0,00 |

| Hasil Simulasi | |

|---|---|

| Jenis Pinjaman | Modal Kerja Sederhana |

| Jenis Usaha | Jasa |

| Penjualan Perbulan | 0 |

| Total Pinjaman di Bank Lain | 0 |

| Kebutuhan modal kerja Anda | 0 |

| Total limit yang dapat diberikan | 0 |

| Hasil Simulasi Perhitungan | |

|---|---|

| Jenis Pinjaman | Modal Kerja Lengkap |

| Rata-rata penjualan perbulan | 0 |

| Harga pokok penjualan | 0 |

| Siklus modal kerja | 0 |

| Piutang | 0 |

| Inventori | 0 |

| Hutang dagang | 0 |

| Kebutuhan modal kerja | 0 |

Produk Asuransi Jiwa yang memberikan Manfaat Perlindungan jangka panjang untuk mempersiapkan dana masa depan.

Mapan, Cerminan Keluarga Idaman

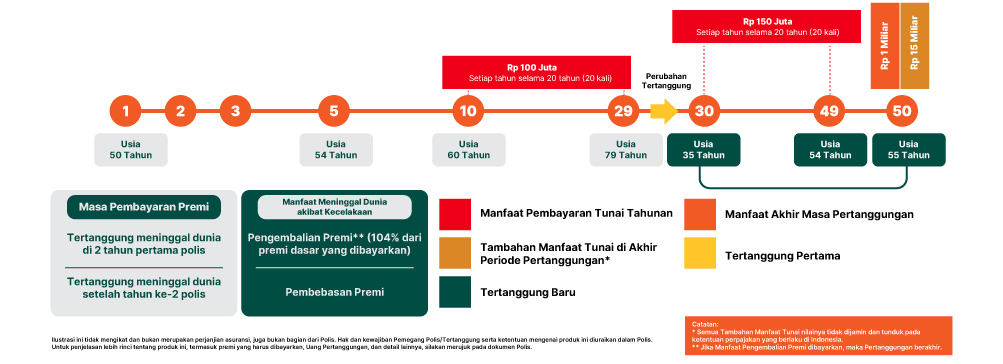

Setiap keluarga tentunya memiliki rencana yang mapan dalam melindungi keluarga dan juga keturunannya. Agar masa depan keluarga terjamin, maka diperlukan sebuah perlindungan prima yang dapat mewujudkan rencana tersebut. Perlindungan yang dapat menjaga setiap keluarga untuk senantiasa memastikan mereka saling melihat kebahagiaan yang terpancar dari keluarga dan keturunannya kelak.

Untuk melengkapi kemapanan yang Anda peroleh saat ini agar tetap dapat dinikmati oleh generasi selanjutnya, Manulife Indonesia dan Danamon mempersembahkan Proteksi Prima Masa Depan, produk Asuransi Jiwa yang memberikan Manfaat Perlindungan jangka panjang untuk mempersiapkan Dana Masa Depan dengan keunggulan 3A yang Mapan.

*Sesuai dengan Syarat dan Ketentuan yang berlaku

**Perubahan Tertanggung hanya dapat dilakukan maksimal 3 kali selama Masa Pertanggungan

***Menggunakan skenario tingkat pengembalian sedang untuk mata uang Rupiah

Catatan:

*Tambahan Manfaat Tunai tidak dijamin dan tunduk pada ketentuan perpajakan yang berlaku di Indonesia

**Perhitungan manfaat meninggal akibat Kecelakaan akan tetap menggunakan Premi Tahunan berdasarkan

perhitungan Manulife Indonesia meskipun pembayaran Premi dilakukan secara bulanan, tiga bulanan, atau

enam bulanan

Pelayanan dan penyelesaian pengaduan nasabah tidak dipungut biaya.

Bagi Anda yang berminat silahkan datang ke cabang-cabang Bank Danamon yang terdekat atau klik dibawah ini