Fitur

- Beragam kanal pembayaran (cabang dan online)

- Beragam jenis pembayaran penerimaan Negara

- Proses dan status pembayaran yang dapat di monitor secara online

Manfaat

- Pembayaran penerimaan Negara single atau multi-billing melalui (DCC) dan Cabang Bank Danamon

- Waktu yang Fleksibel

- Tersedia pembayaran secara bulk

- Menerima Bukti Pembayaran Negara (BPN) secara online

Informasi

Informasi lebih detail mengenai Modul Penerimaan Negara

Silahkan hubungi Hello Danamon di 1-500-090 atau email

hellodanamon@danamon.co.id

FAQ

Modul Penerimaan Negara adalah sistem elektronik yang terintegrasi untuk pengelolaan penerimaan negara melalui kode billing sehingga memberikan kemudahan bagi wajib pajak, wajib bayar, dan wajib setor agar semua setoran dapat diaplikasikan dengan lebih praktis, cepat dan aman melalui kanal pembayaran yang disediakan oleh Bank

- Kode Billing Dirjen Pajak (Setoran Pajak Persepsi)

• Melalui Danamon Cash Connect. Link: https://cashconnect.danamon.co.id/

• Melalui Web Dirjen Pajak. Link: https://sse.pajak.go.id/

- Kode Billing Dirjen Bea dan Cukai (Setoran Pajak Ekspor dan Impor)

• Link: https://customer.beacukai.go.id/

- Kode Billing Dirjen Anggaran (Setoran PNBP)

• Link: https://simponi.kemenkeu.go.id/index.php/welcome/login

Pembayaran Modul Penerimaan Negara dapat dilakukan di Kantor Cabang Danamon (Teller) dan Layanan Danamon Cash Connect

- Setoran Pajak Persepsi

Pada kategori ini, kamu bisa membayar semua pajak yang berada di bawah naungan Direktorat Jenderal Pajak, seperti Pajak Penghasilan (PPh), PPh 21, PPh 22, PPh 23, PPh 25, PPh 26, PPh 29, PPh Final

- Setoran Pajak Ekspor dan Impor

Pada kategori ini, kamu bisa membayar biaya customs / bea cukai (dibawah naungan Direktorat Jenderal Bea Cukai)

- Bayar Penerimaan Negara Bukan Pajak (PNBP)

Pada kategori ini, kamu bisa membayar biaya/pajak yang berada di bawah naungan Direktorat Jenderal Anggaran, seperti biaya perpanjangan paspor dan biaya perpanjangan SIM

- Pembuatan ID Billing dan Pembayaran Pajak dapat menggunakan Menu Modul Penerimaan Negara --> Single Billing G3

- Khusus untuk Pembuatan ID Billing dan Pembayaran Pajak secara massal, dapat menggunakan Modul Penerimaan Negara --> Multi Billing G3

Jika Anda tidak memiliki menu tersebut, hubungi Tim Transaction Banking Implementasi (email: tb.servicecash@danamon.co.id).

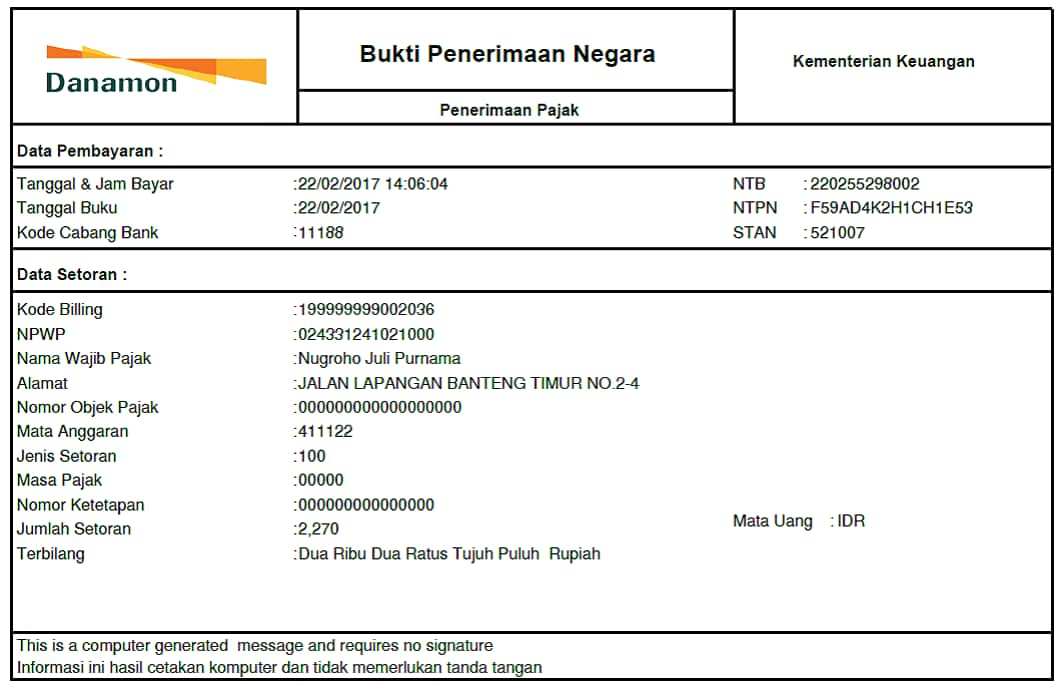

Bukti bahwa pembayaran Modul Penerimaan Negara telah berhasil, jika pendebitan rekening Anda atas transaksi tersebut telah berhasil dilakukan dan Bukti Penerimaan Negara (BPN) dapat dicetak. Anda dapat melihat Bukti Penerimaan Negara pada menu BPN Report.

CATATAN: Lakukan selalu pengecekan terlebih dahulu apakah rekening telah terdebit setelah melakukan transaksi Modul Penerimaan Negara. Jika rekening sudah terdebit tetapi tidak mendapatkan BPN/NTPN atau mendapatkan respon timeout, jangan melakukan transaksi ulang, segera hubungi Transaction Banking Service (email: tb.service@danamon.co.id)

Untuk informasi referensi langkah-langkah cara mendapatkan kode billing silakan klik disini

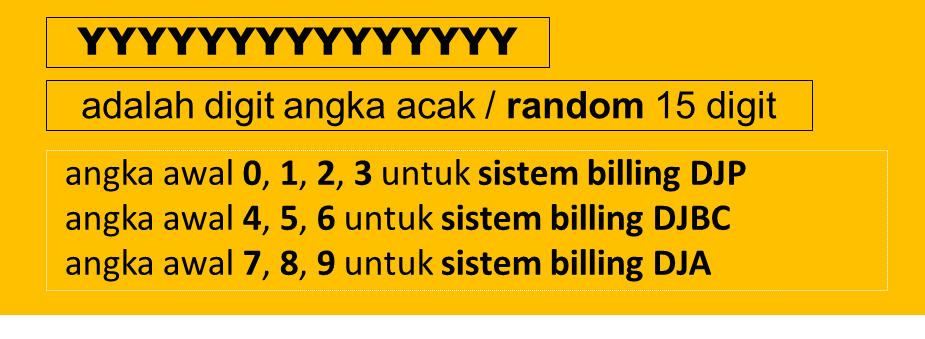

Format Kode Billing:

Kode Billing adalah kode identifikasi yang diterbitkan oleh sistem billing atas suatu jenis pembayaran atau setoran yang akan dilakukan wajib pajak/wajib bayar/wajib setor dalam rangka identifikasi penerbit kode billing dalam Modul Penerimaan Negara. Terdiri atas 15 digit angka, dimana digit pertama adalah kode penerbit billing.

Contoh Gambar Format Kode Billing adalah sebagai berikut:

Apabila transaksi kamu sudah berhasil di proses, kamu akan mendapatkan Bukti Penerimaan Negara.

Contoh Bukti Penerimaan Negara adalah sebagai berikut:

Ya, masa berlaku dari kode bayar/kode billing untuk Setoran Pajak Persepsi adalah 30 hari. Sedangkan masa berlaku dari kode bayar/kode billing untuk Pajak Ekspor dan Impor serta Penerimaan Negara Bukan Pajak (PNBP) mengikuti ketentuan umum yang berlaku.

Hubungi Kami

Hubungi Kami

Lokasi Kami

Lokasi Kami

E-Form

E-Form

Layanan Whistleblower

Layanan Whistleblower