D-Point Terms and Condition

I. DEFINITIONS

Unless otherwise explicitly stated in the relevant sentence, all terms used in these General Terms and Conditions shall have the following meanings:

- Bank is PT Bank Danamon Indonesia Tbk, located in South Jakarta.

-

CIF (Customer Identification File) is a unique number issued by the Bank to identify each Customer.

-

Time Deposit refers to a deposit that can only be withdrawn at a specific time and under certain conditions.

- D-Bank PRO is a banking information and transaction service provided by the Bank to Customers, which can be accessed by Customers using their mobile phones.

- D-Point is a reward point earned by Customers through banking transactions/activities, the amount of which is determined by the Bank.

-

Current Account refers to a Customer’s deposit at the Bank that can be withdrawn using checks, demand deposit slips, and/or other payment instruments.

-

Danamon Debit/ATM Card is a card issued by the Bank upon the Customer’s request, functioning as an ATM card and/or debit card and/or other functions as determined by the Bank.

-

Danamon Credit Card is a card issued by the Bank and provided to the Customer upon request, under the license of a Principal (including but not limited to Visa, Mastercard, and JCB) in cooperation with the Bank. It can be used as a payment instrument for obligations arising from economic activities, including purchases and/or cash withdrawals, where the payment obligation is initially fulfilled by the Issuer or the Bank, and the Customer is required to repay the obligation either in full or in installments by the due date each month or as otherwise agreed.

-

Customer refers to an individual who holds an account with the Bank and/or uses banking facilities/services provided by the Bank.

- Mutual Funds are vehicles used to collect funds from investors for subsequent investment in securities portfolios by investment managers. In this case, customers can own mutual funds through the Bank in its capacity as a securities selling agent in the form of mutual funds (APERD) through channels available at the Bank.

- Savings are one of the Bank's customer deposit products with types, terms and conditions in accordance with the provisions applicable at the Bank.

- OTP (One Time Password) is a secret code sent via text message (SMS) to the customer's mobile phone number registered in the Bank's system and listed on the Exchange Channel.

-

Redemption Channel refers to the D-Point redemption website at dpoint.id, used by Customers to redeem D-Points for various available rewards, or other channels provided by the Bank.

- General Terms and Conditions are the General Terms and Conditions of Danamon Reward D-Point.

II. GENERAL PROVISIONS OF D-POINT

-

The Customer hereby acknowledges that the Bank has provided sufficient explanation regarding the characteristics of D-Point to be used by the Customer, and the Customer has understood and accepted all consequences of using D-Point, including its benefits, risks, and associated fees, which are also available through the Bank’s communication channels.

-

By redeeming D-Points through the Redemption Channel in accordance with these General Terms and Conditions, the Customer is deemed to have read, understood, agreed to, and accepted to be bound by these General Terms and Conditions.

- Customer who has an account at the Bank and conducts transactions in accordance with these General Terms and Conditions as well as the Bank's prevailing policies will earn D-Points.

- Customers with a joint account, the D-Points will be awarded to the primary account holder whose name appears first on the joint account.

- Customers can access information reports regarding D-Point earnings on the Exchange Channel.

III. D-POINT VALIDITY PERIOD

-

The maximum validity period of D-Points is 3 (three) years from the date they are credited by the Bank. D-Points earned by Customers cannot be used or claimed if:

-

If the Customer does not redeem the points within three (3) years of being credited, the points will expire.

-

If the Customer closes all accounts and/or Danamon Credit Cards, all accumulated D-Points will expire, even if the three-year validity period has not yet elapsed.

-

If the Customer does not redeem the points within three (3) years of being credited, the points will expire.

- The Customer's right to D-Points shall automatically cease if the Account or Credit Card is closed and/or the Bank declares the Customer ineligible to collect or redeem D-Points due to fraudulent conduct in D-Point accumulation or violation of the Bank's prevailing regulations or applicable laws and regulations in Indonesia. In such case, the Bank reserves the full right to revoke the Customer's ownership of D-Points.

IV. PRODUCT CRITERIA ELIGIBLE FOR D-POINTS

The following products are eligible for D-Points and serve as the basis for D-Point calculation:

- Danamon Debit/Danamon ATM

- Danamon Credit Card

- D-Bank PRO

- Mutual Funds

- Savings Account*

- Current Account (Giro)*

- Time Deposit*

*) D-Points are awarded only during special programs organized by the Bank.

V. D-POINT ALLOCATION MECHANISM

- D-Points will be credited to the Customer's D-Point account at the end of the month based on the Customer's accumulated banking transactions in 1 (one) CIF in accordance with these General Terms and Conditions.

- D-Points awarded for Credit Card transactions and Debit Card/ATM transactions cannot be combined/accumulated.

- D-Points earned from Debit/ATM Cards, D-Bank PRO, and Mutual Funds will be credited to the Customer's D-Point account which is linked to the Debit/ATM Card.

-

D-Points earned from transactions using a Credit Card will be credited to the Customer's Credit Card-based D-Point account at the end of each month based on the following D-Point calculation:

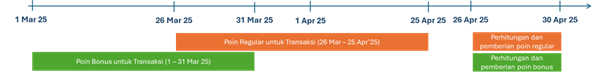

- Regular D-Points are calculated based on transactions recorded by the Bank from the 26th of the previous month to the 25th of the current month.

- Bonus D-Points (if any) are calculated based on transactions recorded by the Bank from the 1st to the last day of the previous month.

- - D-Point credits at the end of April 2025 will be made between 26 and 30 April 2025.

-

- The D-Point components credited are for:

- Regular D-Points from transactions recorded by the Bank between 26 March and 25 April 2025.

- Bonus D-Points from transactions recorded by the Bank between 1 March and 31 March 2025.

VI. BASIC POINT CALCULATION MATRIX

The following is the basic matrix for D-Point calculation:

| Product | Type of Transaction/Activity | Total Point |

|---|---|---|

| Debit Card | Purchases at various merchants, either through EDC (payment transaction machines) or online payments, with a minimum transaction of IDR 7,500.00, applicable in multiples. | 1 D-Point |

| Danamon Visa and Mastercard® Platinum Credit Card |

|

1 D-Point

|

| Danamon JCB Precious Credit Card | ||

| Danamon Grab Credit Card | ||

| Danamon Mastercard® World Credit Card | ||

| Danamon Mastercard® World Business Credit Card | ||

| Danamon VISA Infinite Credit Card | ||

| Danamon World Elite™ Mastercard® Credit Card | ||

| E–Channel (D-Bank PRO) | Payment transactions, purchases or transfers at least 5 times per month (not applicable to multiples). | 250 D-Point |

| Mutual Fund | Purchase of mutual fund products with a minimum value of IDR 1,000,000.00 (multiples apply). Not applicable to money market and bond mutual funds. *)Non-IDR amounts will be converted to IDR using the mid-rate applicable at the Bank on the 26th of the current month / the last working day before the 26th of the current month (if the 26th falls on a holiday). | 20 D-Point |

*) There is a limit on the number of transactions for calculating D-point Bonuses (if any), which is a maximum of 1 (one) times the card limit (including if the card is undergoing a temporary limit increase) given by the Bank to the Customer.

| Simulation A | ||

|---|---|---|

| Type of Transaction | D-Point | |

| Transaction using Danamon Platinum Credit Card | IDR 1,299,500 | = 519 D-Point |

| Total Point | = 519 D-Point | |

| Simulation B | ||

|---|---|---|

| Type of Transaction | D-Point | |

| Transaction using Danamon Debit Card | IDR 2,5 Million | |

| Total Point | = 333 D-Point | |

| Simulation C | ||

|---|---|---|

| Type of Transaction | D-Point | |

|

Payment, purchase, or transfer transactions with a minimum of 5 times in the same month via D-Bank PRO |

=250 D-Point | |

| Mutual Fund Transaction of IDR 50 Million | = 1000 D-Point | |

| Total Point | = 1.250 D-Point | |

| Simulation D | |

|---|---|

| Type of Transaction | D-Point |

|

Mutual Fund transaction with a nominal value of USD 5,000 on 22 April 2025 Conversion of USD to IDR using the mid rate applied by the Bank on 25 April 2025 (26 April 2025 falls on a public holiday): Mid-rate used by the Bank as of 25 April 2025: IDR 16,830.00 IDR Amount: 5000 * IDR 16,830.00 = IDR 84,150,000.00 |

= 1.680 Point |

|

Mutual Fund transaction with a nominal value of USD 5,000 on 12 June 2025 Conversion of USD to IDR using the mid-rate applied by the Bank on 26 June 2025 Mid-rate used by the Bank as of 26 June 2025: IDR 16,204.00 IDR Amount: 5000 * IDR 16,204.00 = IDR 81,020,000.00 |

= 1.620 Point |

| Total D-Points | = 3.300 Point |

VII. D-Point Redemption Terms and Conditions

-

D-Points may be redeemed for a variety of products/services (“Rewards”) through the Redemption Channels.

-

Redemption of D-Points through the Redemption Channels shall be subject to the following conditions:

- Each redemption transaction requires the Customer to have a registered email address in the Bank’s system. If not registered, the Customer must first provide their personal email address to the Bank.

- Customers must read, understand, and agree to these General Terms and Conditions and the specific terms and conditions of the selected Reward.

- When exchanging D-Points, Customers are required to log in to verify and authenticate their data, after which the Bank will send an OTP to the Customer's mobile phone number registered in the Bank's system. Customers must ensure that the mobile phone number registered in the Bank's system is the Customer's active and currently used phone number.

- Customers may select rewards that can be redeemed with D-Points.

- After the D-Point redemption process is successful, customers will receive a notification regarding the successful D-Point redemption transaction to the email address registered in the Bank's system.

- The Bank works with third parties/vendors to exchange D-Points for Rewards and deliver the Rewards. These third parties/vendors will provide and deliver the Rewards to Customers.

- D-Points that have been redeemed cannot be canceled by the Customer.

- Rewards that have been selected to be exchanged for D-Points cannot be returned or exchanged for cash or other items.

- In the event that the Bank or third party/vendor is unable to deliver the Reward, the Bank will refund the exchanged D-Points to the Customer within a maximum of 3 (three) working days from the Bank's notification that the Reward delivery cannot be fulfilled.

- There are no additional fees for exchanging D-Points for Rewards through the Exchange Channel.

VIII. Representations and Warranties

- The Customer hereby declares and guarantees that every instruction to exchange D-Points for Rewards selected by the Customer is made in good faith.

- The Customer agrees that every instruction to exchange D-Points through the Customer's Exchange Facility that is received and executed by the Bank based on these General Terms and Conditions is true, complete, accurate, correct, valid and binding on the Customer.

- The Customer further declares and agrees that the Bank has the right to record or document every redemption instruction submitted by the Customer, and that such records and/or communications (including but not limited to video recordings, images, transaction logs, tapes/cartridges, or copies thereof) shall be accepted as valid and binding evidence.

- The Customer affirms that the redemption of D-Points is initiated solely by the Customer, without coercion from any party.

-

In connection with the submission of D-Point redemption instructions, the Customer acknowledges:

- The Bank has the absolute authority to accept or reject D-Point exchange instructions from Customers.

- In the event that additional requirements/documents and/or information from the Customer are necessary for the execution of the D-Point exchange instruction, the Customer agrees to fulfil/complete the requirements at any time by signing the documents and/or providing the information required/specified by the Bank and/or applicable laws and regulations, and to accept all consequences arising from the failure to fulfil such requirements.

-

Customers acknowledge and understand that exchanging D-Points carries certain risks, including:

- Transactions that are not carried out by the Customer or Customer data being used by other parties who are not authorised to do so as a result of negligence on the part of the Customer and/or data leaks;

- Delays or failures in access, as well as delays or failures in the provision of D-Point-related information/data or the execution of transactions instructed by the Customer, may occur due to, among other things: force majeure events, misuse of D-Points contrary to the provisions established by the Bank under these General Terms and Conditions, or other causes beyond the Bank’s control.

- Data/information presented by the Bank may be inaccurate or corrupted due to interference from parties attempting to infiltrate or damage the data, or other third parties acting in bad faith.

- The Bank may, at its discretion, decide not to award D-Points or terminate the awarding of D-Points to Customers by giving prior notice to Customers in accordance with applicable regulations.

IX. Prohibitions

- The right to use D-Points may not be transferred, in whole or in part, temporarily or permanently, to any other party for any reason without prior written consent from the Bank. The Customer is fully responsible for any misuse of D-Points.

- Customers are prohibited from disclosing to anyone and in any manner whatsoever any customer data/information used to access the Exchange Facility, including but not limited to account numbers, debit/ATM card numbers, credit card numbers and OTPs.

- Customers acknowledge and agree that any violation of the provisions referred to in points 1 and 2 will pose a risk to the Customer and the Bank reserves the right to cancel or terminate the D-Points awarded to the Customer.

X. Miscellaneous

- These General Terms and Conditions constitute an integral part of the "General Terms and Conditions for Accounts and Banking Services" or "General Terms and Conditions for Sharia Accounts and Banking Services", "General Terms and Conditions for Danamon Credit Card Membership", the "General Terms and Conditions for Danamon American Express Credit Card and Charge Card Membership", the "General Terms and Conditions for D-Bank PRO Services" and the general terms and conditions for related products or services. In the event of any discrepancy or conflict between these provisions and these General Terms and Conditions, these General Terms and Conditions shall prevail.

- The Customer hereby agrees and acknowledges that the Bank reserves the right to revise, amend, or supplement these General Terms and Conditions from time to time. Any changes, additions, or updates to these General Terms and Conditions will be communicated through the Bank’s available communication channels. In the event of changes to the benefits, risks, fees, terms, or conditions under these General Terms and Conditions, the Customer has the right to submit a written objection to the Bank within thirty (30) business days from the date the Bank provides such notification through its communication channels. The Customer agrees that if no objection is submitted within the specified period, the Customer shall be deemed to have accepted the changes. If the Customer does not agree to the changes, the Customer has the right to cancel or terminate the Bank’s products or services, provided that all outstanding obligations to Bank Danamon (if any) are first settled.

- The Customer declares that there are no and will not be any transactions suspected of money laundering and/or other prohibited activities under the applicable laws and regulations of Indonesia.

- If there are indications of fraud, cheating, abuse, transaction irregularities, unusual transactions, money laundering and/or actions that do not comply with laws and regulations, the Bank reserves the right to cancel or terminate D-Points. Customers are still required to settle all their obligations to the Bank (if any).

- If any provision in these General Terms and Conditions is prohibited, unenforceable, or declared null and void by government regulation or court decision, such invalidity shall not affect the validity of the remaining provisions, which shall remain binding and enforceable as stipulated in these General Terms and Conditions. With respect to any provision that is prohibited or unenforceable, the Bank will adjust and replace it with a provision that is enforceable in accordance with the Bank’s policy.

- The headings and terminology used in these General Terms and Conditions are solely intended to facilitate understanding of the content.

- PT Bank Danamon Indonesia Tbk is licensed and supervised by the Financial Services Authority (Otoritas Jasa Keuangan/OJK) and is a participant in the Deposit Insurance Corporation (Lembaga Penjamin Simpanan/LPS) guarantee program.

- These General Terms and Conditions have been adjusted to comply with applicable laws and regulations, including those issued by the Financial Services Authority.

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service