Informasi Produk

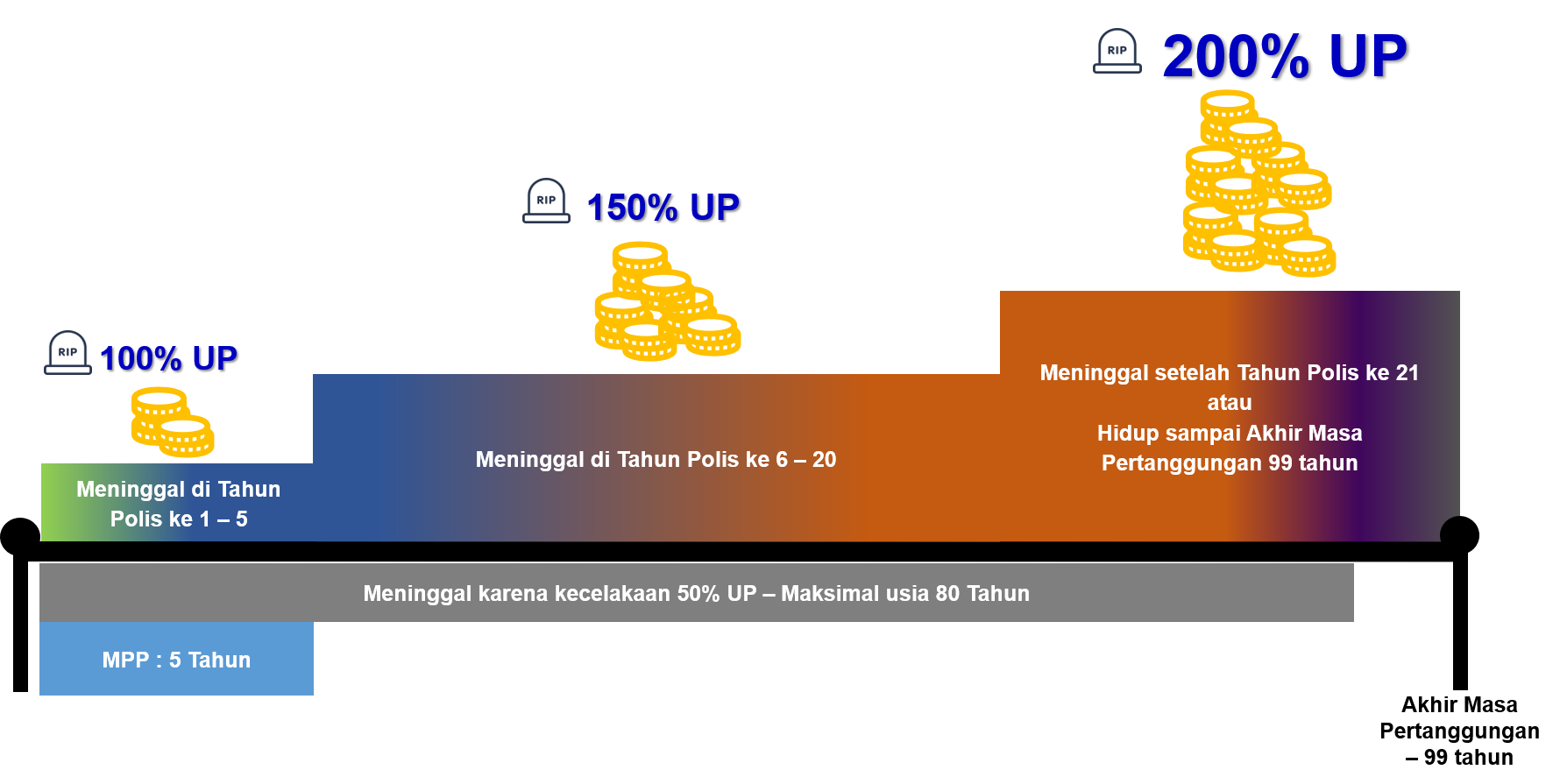

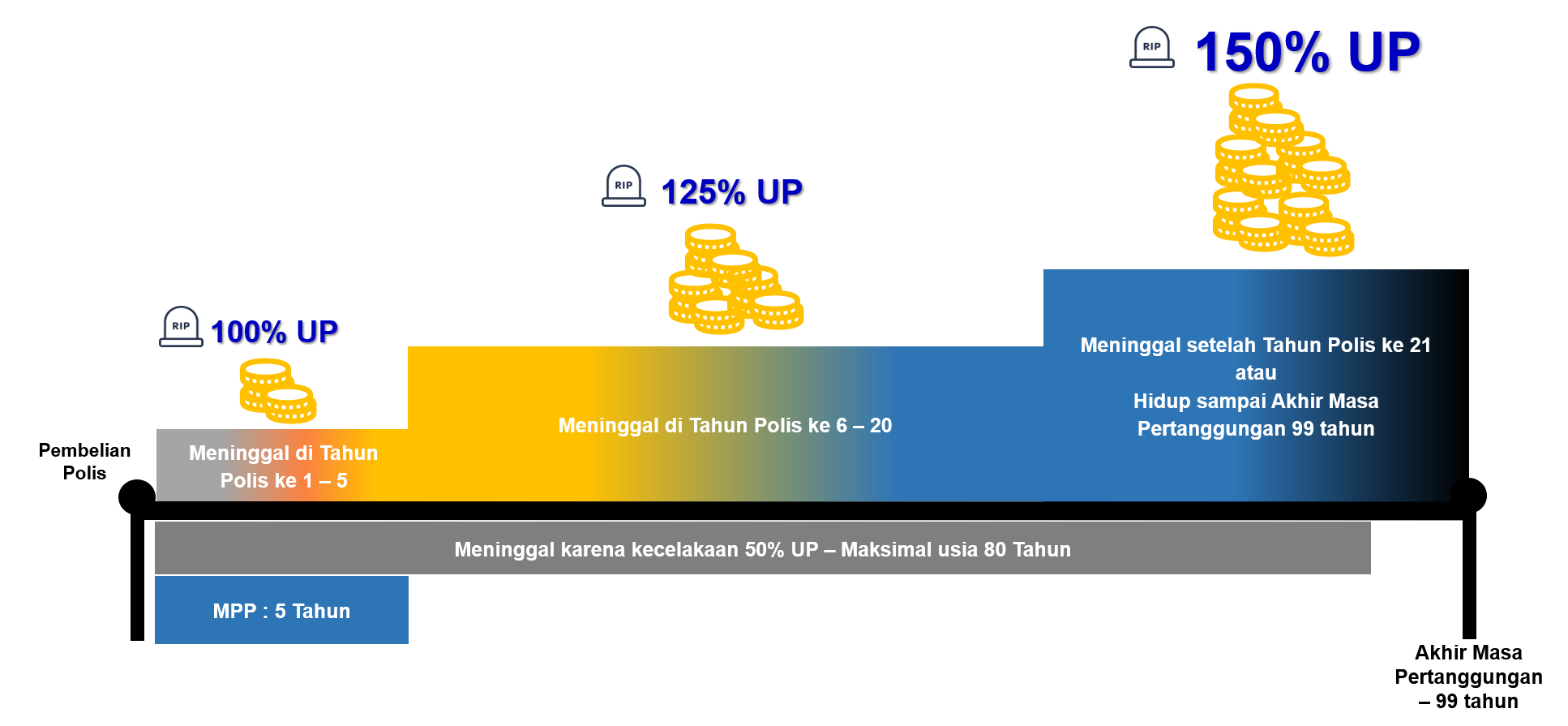

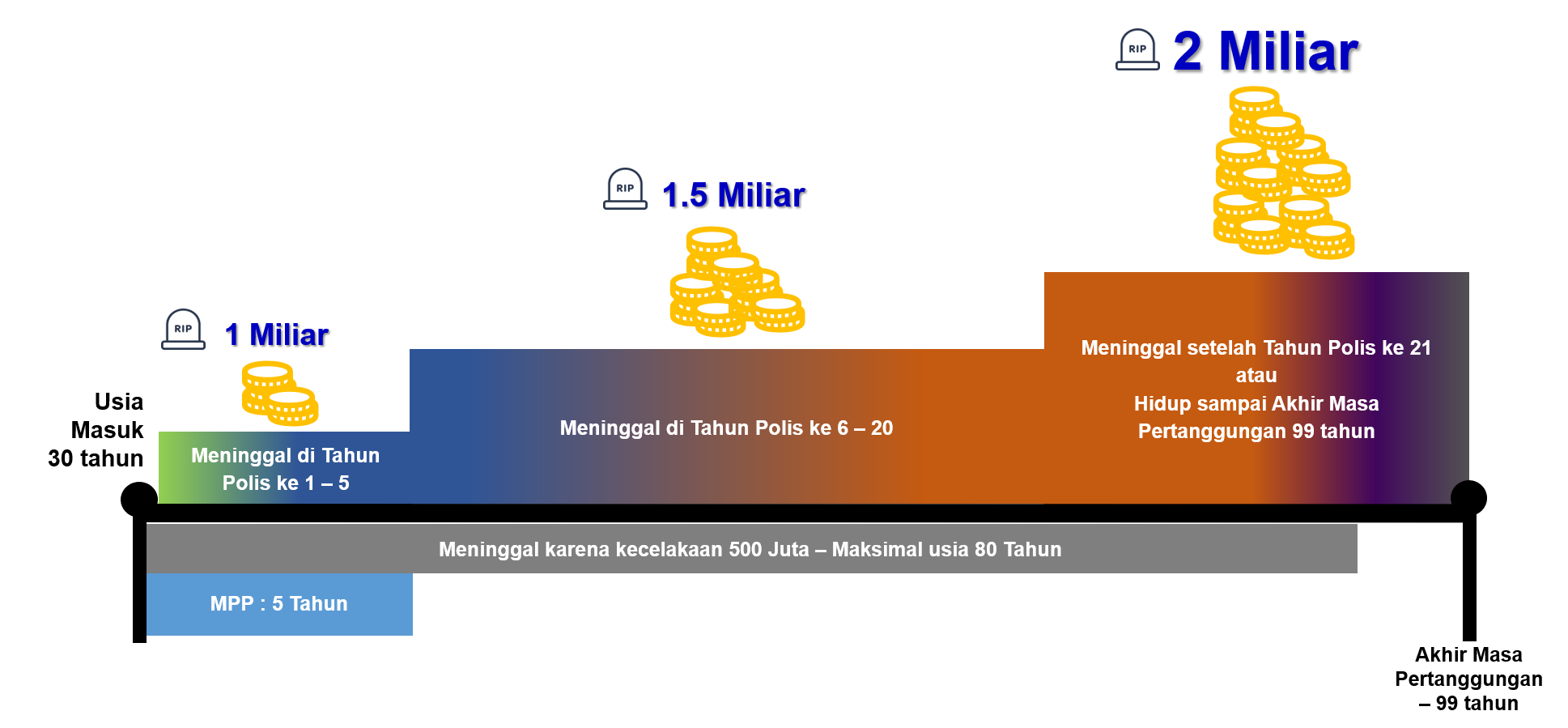

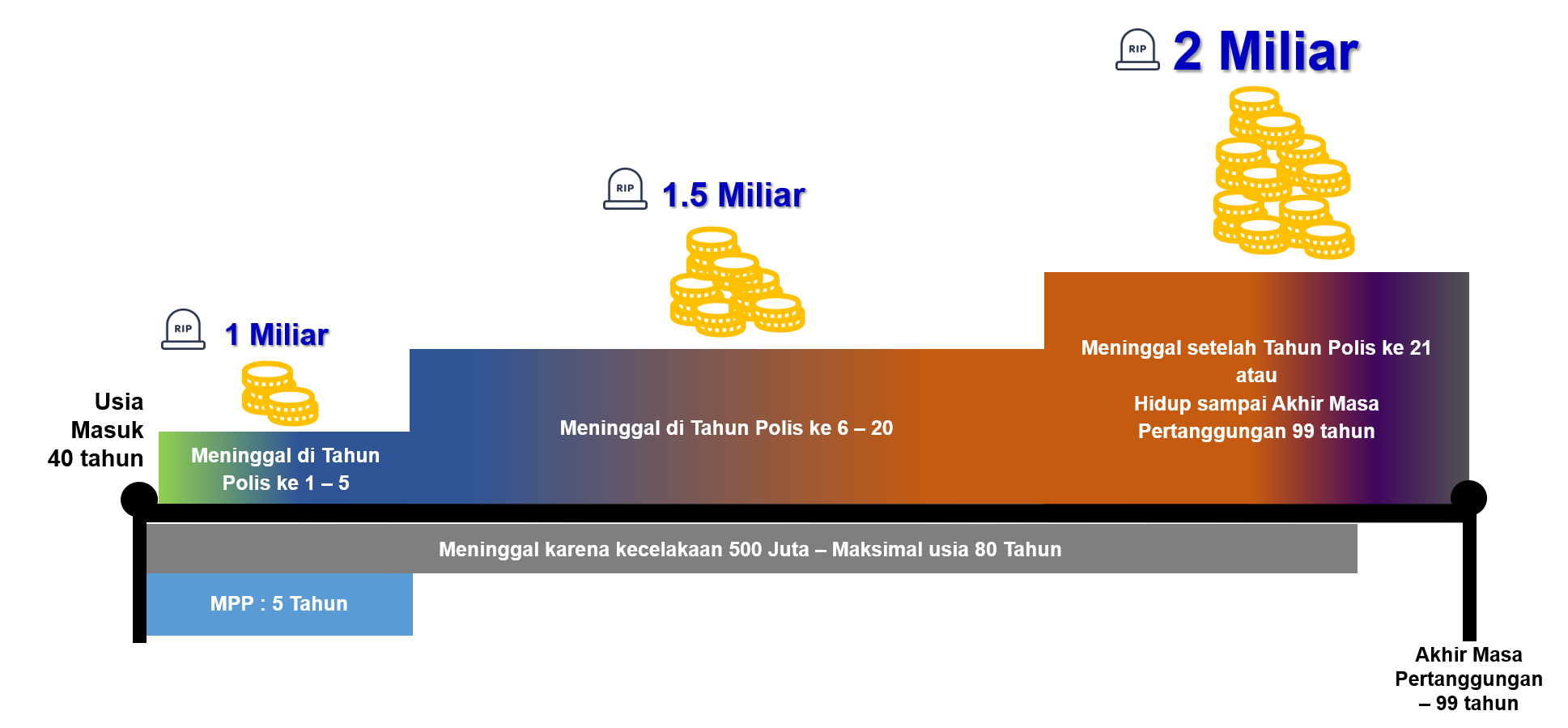

Proteksi Prima Warisan Terencana adalah produk asuransi jiwa seumur hidup yang memberikan manfaat Meninggal Dunia, Tambahan Manfaat Meninggal Dunia Karena Kecelakaan, dan Manfaat Akhir Masa Pertanggungan sampai dengan Tertanggung mencapai usia 99 tahun.

Hubungi Kami

Hubungi Kami

Lokasi Kami

Lokasi Kami

E-Form

E-Form

Layanan Whistleblower

Layanan Whistleblower