24-Hour Information and Complaint Service

hellodanamon@danamon.co.id

Website

https://www.danamon.co.id

Hello Danamon

1-500-090

Quick Access

Quick Access

IDR

IDR

IDR

IDR

USD

USD

EUR

EUR

IDR

IDR

IDR

IDR

USD

USD

EUR

EUR

| Simulation Results | |

|---|---|

| Investment Goals | Future Investment |

| Komparasi Jenis Aset Konvensional : | Time Deposit |

| Komparasi Jenis Aset Investasi : | Small Mid Cap Equity Funds |

| Nominal Investasi Awal | 0,00 |

| Nominal Investasi Bulanan | 0,00 |

| Time Deposit | Small Mid Cap Equity Funds |

|---|---|

|

Total Savings + Return

71.228.531,00

|

Total Savings + Return

78.729.940,72

|

|

Total Savings

70.000.000,00

|

Total Savings

70.000.000,00

|

|

Total Return

1.228.531,00

|

Total Return

8.729.940,72

|

|

Nilai Pertumbuhan %

1,76%

|

Nilai Pertumbuhan %

12,47%

|

|

Jangka Waktu Investasi

20 Tahunan

|

Jangka Waktu Investasi

20 Tahunan

|

| Simulation | |

|---|---|

| Property Prices | 0,00 |

| Down Payment | 0,00 |

| Investment Period | 1 Year |

| Annual Interest Rate (%) | 0% |

| Loan Amount | 0,00 |

| Monthly Installment | 0,00 |

| Simulation Results: | |

|---|---|

| Your Loan Amount | 0,00 |

| Loan Period | 1 Month |

| Monthly Interest Rate (%) | 0% |

| Total Monthly Installment | 0,00 |

| Simulation Table | |

|---|---|

| Type of Loan | Simple Working Capital |

| Type of Business | Service |

| Monthly Sales | 0 |

| Total Loans from Other Banks | 0 |

| Kebutuhan Modal Kerja | 0 |

| Total limit yang dapat diberikan | 0 |

| Simulation Table | |

|---|---|

| Type of Loan | Complete Working Capital |

| Average monthly sales | 0 |

| Cost of goods sold | 0 |

| Siklus Modal Kerja | 0 |

| Piutang | 0 |

| Inventori | 0 |

| Hutang Dagang | 0 |

| Kebutuhan Modal Kerja | 0 |

100% Protection of Principal Amount

This product is ideal for Customers who want 100% protection on their Principal Amount if the product be held until maturity and obtain a higher rate of return compared to conventional time deposits.

The maximum investment return is achieved if the Option reaches the upper/lower limit within the specified date and time.

The maximum investment return is achieved if the Option does not reach the upper/lower limit within the specified date and time.

The maximum investment return is achieved if the Option does not reach both the upper and lower limits set within the specified date and time.

Subject to market conditions and offering from the bank.

Offers higher returns than regular time deposits.

Starts from USD 10,000 or equivalent.

Tenor up to 1 (one) year.

No management or placement fees.

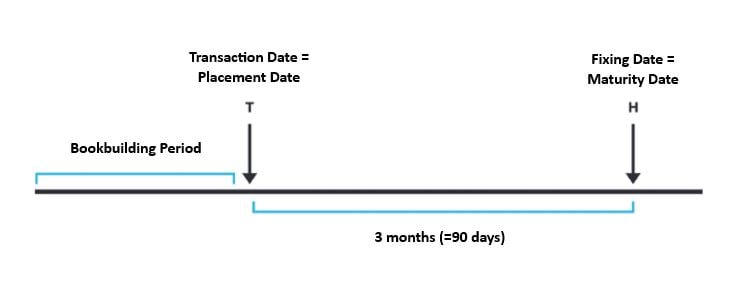

Customer joins MLD with below details:

Placement: USD 50,000

Currency: USD

Currency Pairing: AUD/USD

Spot: 0.6927

Lower Limit: 0.6897

Tenor: 3 months (=90 days)

Minimum Payout: 0.50% gross

Maksimum Payout: 2.70% gross

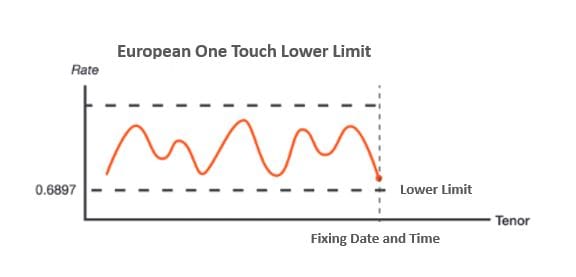

MLD Type: European One Touch

Payout Description:

Scenario A

At fixing date and time, rate at 0.6917 →

does not touch lower limit, then

Customer get Minimum

Payout.

Customer Earnings:

Placement Amount + ((Placement Amount x Payout Amount x

(Tenor/365)) – Tax 20%)

= USD 50,000 + ((USD 50,000 x 0.5% x (90/365)) - Pajak 20%)

= USD 50,049.32 net

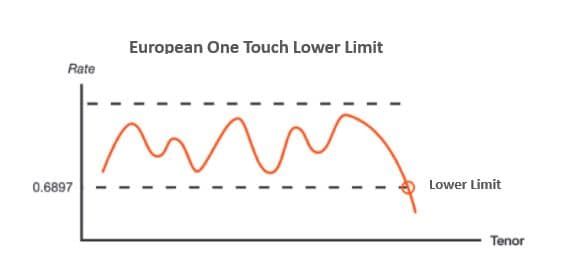

Scenario B

At fixing date and time, rate at 0.6887 →

touch lower limit, then Customer

get Maximum Payout.

Customer Earnings:

Placement Amount + ((Placement Amount x Payout Amount x

(Tenor/365)) – Tax 20%)

= USD 50,000 + ((USD 50,000 x 2.7% x (90/365)) – Tax 20%)

= AUD 100,197.26 net

= AUD 100,197.26 x 0.6380

= USD 50,266.30 net

*Changes to the General Terms and Conditions of Market Linked Deposit (Effective September 1, 2025). Click here to view the latest Terms and Conditions.

hellodanamon@danamon.co.id

Website

https://www.danamon.co.id

Hello Danamon

1-500-090