24-Hour Information and Complaint Service

hellodanamon@danamon.co.id

Website

https://www.danamon.co.id

Hello Danamon

1-500-090

Quick Access

Quick Access

IDR

IDR

IDR

IDR

USD

USD

EUR

EUR

IDR

IDR

IDR

IDR

USD

USD

EUR

EUR

| Simulation Results | |

|---|---|

| Investment Goals | Future Investment |

| Komparasi Jenis Aset Konvensional : | Time Deposit |

| Komparasi Jenis Aset Investasi : | Small Mid Cap Equity Funds |

| Nominal Investasi Awal | 0,00 |

| Nominal Investasi Bulanan | 0,00 |

| Time Deposit | Small Mid Cap Equity Funds |

|---|---|

|

Total Savings + Return

71.228.531,00

|

Total Savings + Return

78.729.940,72

|

|

Total Savings

70.000.000,00

|

Total Savings

70.000.000,00

|

|

Total Return

1.228.531,00

|

Total Return

8.729.940,72

|

|

Nilai Pertumbuhan %

1,76%

|

Nilai Pertumbuhan %

12,47%

|

|

Jangka Waktu Investasi

20 Tahunan

|

Jangka Waktu Investasi

20 Tahunan

|

| Simulation | |

|---|---|

| Property Prices | 0,00 |

| Down Payment | 0,00 |

| Investment Period | 1 Year |

| Annual Interest Rate (%) | 0% |

| Loan Amount | 0,00 |

| Monthly Installment | 0,00 |

| Simulation Results: | |

|---|---|

| Your Loan Amount | 0,00 |

| Loan Period | 1 Month |

| Monthly Interest Rate (%) | 0% |

| Total Monthly Installment | 0,00 |

| Simulation Table | |

|---|---|

| Type of Loan | Simple Working Capital |

| Type of Business | Service |

| Monthly Sales | 0 |

| Total Loans from Other Banks | 0 |

| Kebutuhan Modal Kerja | 0 |

| Total limit yang dapat diberikan | 0 |

| Simulation Table | |

|---|---|

| Type of Loan | Complete Working Capital |

| Average monthly sales | 0 |

| Cost of goods sold | 0 |

| Siklus Modal Kerja | 0 |

| Piutang | 0 |

| Inventori | 0 |

| Hutang Dagang | 0 |

| Kebutuhan Modal Kerja | 0 |

High Return

This product is suitable for customers seeking substantial returns alongside a guaranteed rate of return.

You are eligible to invest in foreign currency with DCI if you:

Choices for placement in Rupiah and 8 foreign currencies (USD, AUD, SGD, EUR, CNY, GBP, JPY, NZD) with more than 21 currency pairing alternatives.

Offers higher returns over conventional foreign currency time deposit.

Flexibility to choose the currency pair and establish an agreed target rate (strike price) at the placement date.

With a return on the principal value of the investment denominated in or alternative currency as per the exchange rate performance of the underlying currency at the date and time of determination.

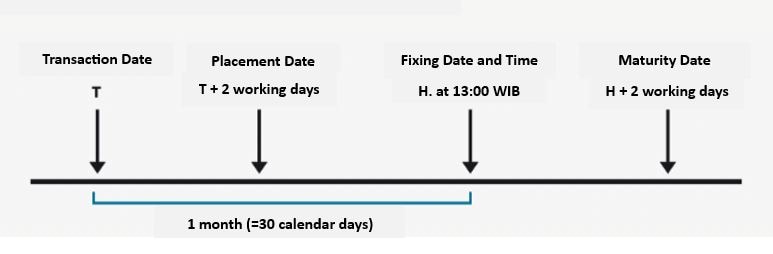

Starting from 1 (one) week.

The determination of the placement result is determined on the date and time of determination.

Illustration for DCI Foreign Currency – Rupiah:

Customer join DCI with below details:

DCI Placement: USD 100,000

Base Currency: USD

Alternative Currency: IDR

Spot USD/IDR at Transaction Date: 14,850

Strike Price: 14,890

Tenor: 1 month (=32 days)

Rate of Return: 3% gross per annum

Tax: 20%

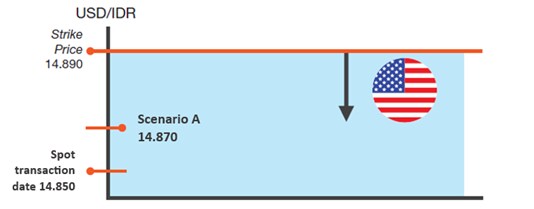

Scenario

A

On the fixing date and time, Spot USD/IDR 14,870

→

spot at fixing

date and time does not reach strike

price,

then Customer will receive principal and

return in

USD.

Customer Earnings:

Placement Amount + ((Placement Amount x Payout

Amount x

(Tenor/365)) – Tax 20%)

= USD 100,000 + ((USD 100,000 x 3% x (32/365))

– Tax

20%)

= USD 100,210.41

net

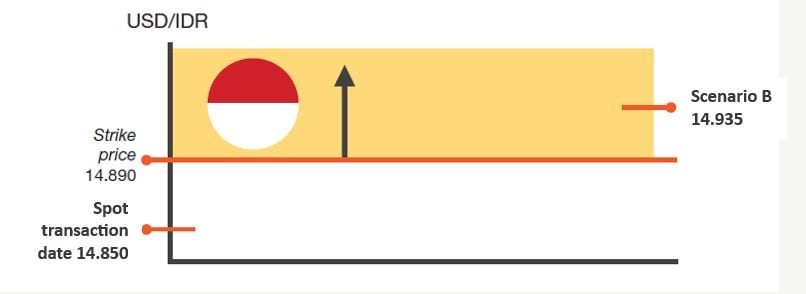

Scenario

B

On the fixing date and time, Spot USD/IDR 14,935

→

spot at fixing

date and time reach strike price,

then

Customer will receive principal and

return in IDR.

Customer Earnings:

Placement Amount + ((Placement Amount x Payout

Amount x

(Tenor/365)) – Tax 20%)

= USD 100,000 + ((USD 100,000 x 3% x (32/365))

– Tax

20%)

= USD 100,210.41 net

= USD 100,210.41 x 14,890 =

IDR 1,492,133,004.90

net

If the Customer in Scenario B directly sell the

DCI result

back to the original currency (USD), they will

receive USD

equivalent to: IDR 1,492,133,004.90 / 14,935 =

USD 99,908.47

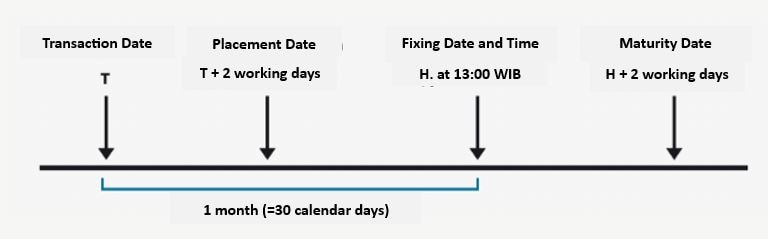

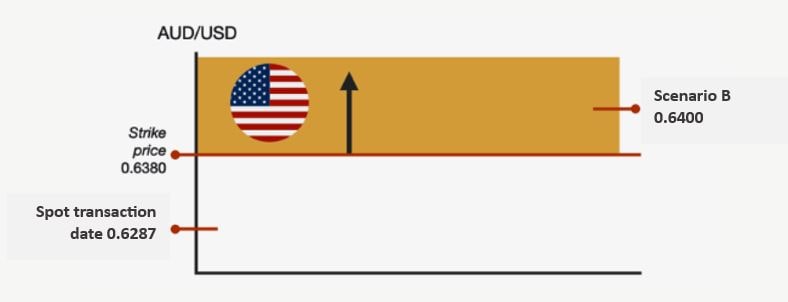

Illustration for DCI Foreign Currency – Foreign Currency:

Customer join DCI with below details:

DCI Placement: AUD 100,000

Base Currency: AUD

Alternative Currency: USD

Spot AUD/USD at Transaction Date: 0.6280/0.6287

Strike Price: 0.6380

Tenor: 1 month (=30 days)

Rate of Return: 3% gross per annum

Tax: 20%

Scenario

A

On the fixing date and time, Spot AUD/USD 0.6250

→

spot at fixing

date and time does not reach strike

price,

then Customer will receive principal and

return in

AUD.

Customer Earnings:

Placement Amount + ((Placement Amount x Payout

Amount x

(Tenor/365)) – Tax 20%)

= AUD 100,000 + ((AUD 100,000 x 3% x (30/365))

– Tax

20%)

= AUD 100,197.26

net

Scenario

B

On the fixing date and time, Spot AUD/USD 0.6400

→

spot at fixing

date and time does reach strike

price,

then Customer will receive principal and

return in

USD.

Customer Earnings:

Placement Amount + ((Placement Amount x Payout

Amount x

(Tenor/365)) – Tax 20%)

= AUD 100,000 + ((AUD 100,000 x 3% x (30/365))

– Tax

20%)

= AUD 100,197.26 net

= USD 100,197.26 x 0.6380 =

USD 63,925.85

If the Customer in Scenario B directly sell the

DCI result

back to the original currency (AUD), they will

receive USD

equivalent to: USD 63,925.85 / 0.6400 = AUD

99,884.14

*Changes to the General Terms and Conditions of Dual Currency Investment (Effective September 1, 2025). Click here to view the latest Terms and Conditions.

hellodanamon@danamon.co.id

Website

https://www.danamon.co.id

Hello Danamon

1-500-090