Product Information

Import LC/SKBDN Financing (ILF) is a further development of LC/SKBDN where Danamon can offer more competitive prices with several alternative funding sources. ILF consists of:

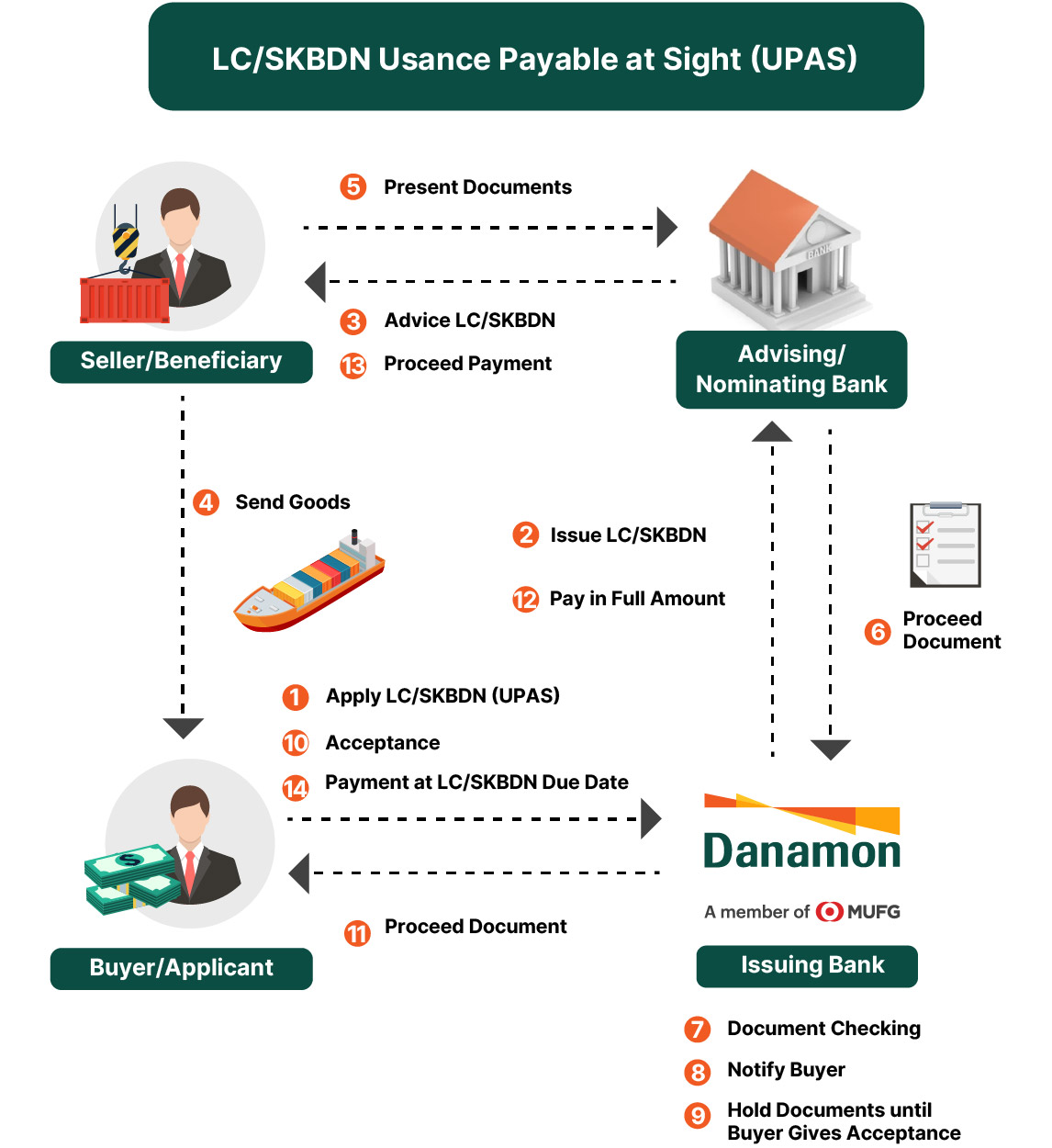

- Usance Payable at Sight (UPAS)

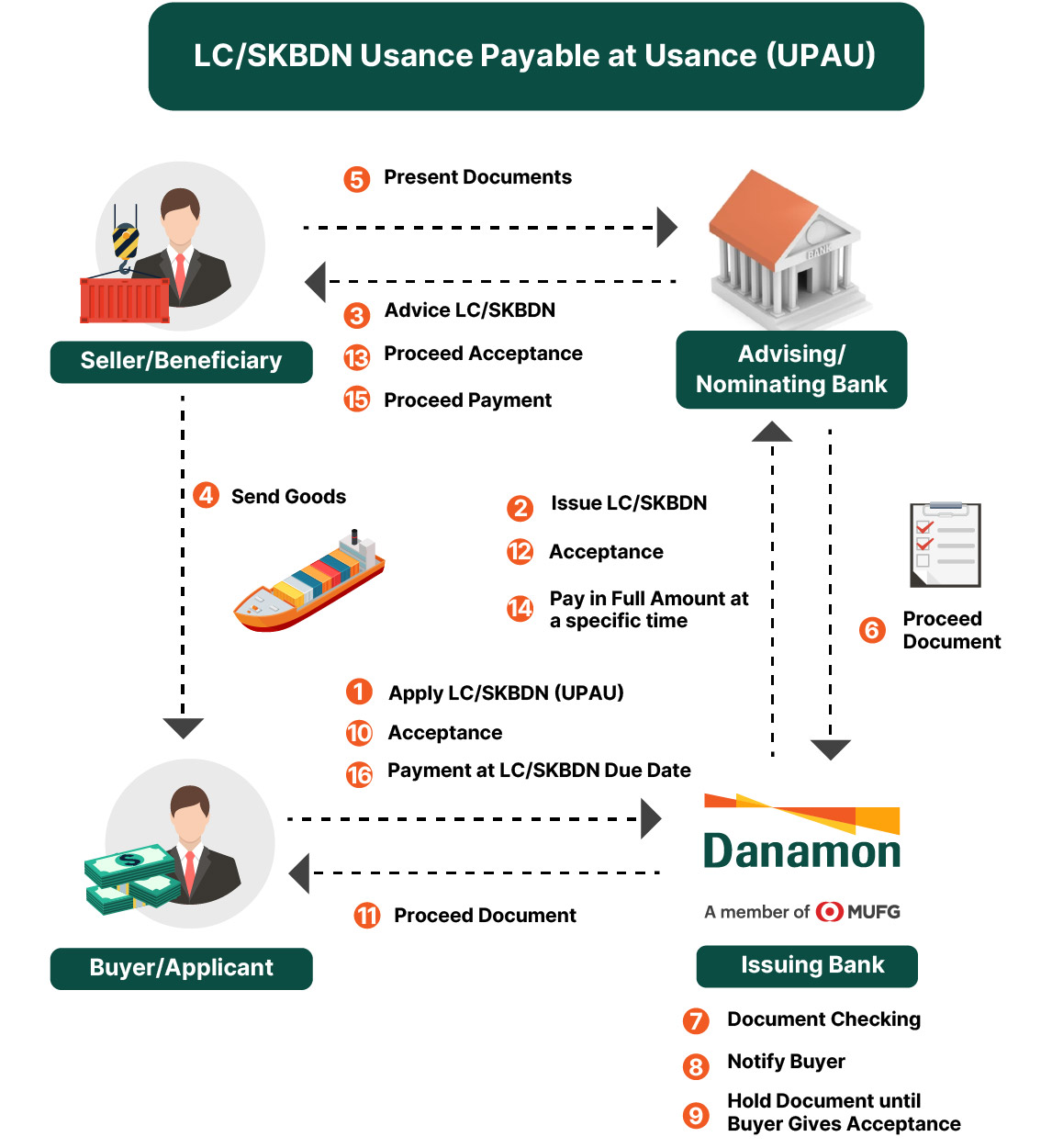

ILF financing where the Seller receives payment at Sight while Buyer can pay LC/SKBDN at Usance tenor written in the LC/SKBDN. - Usance Payable at Usance (UPAU)

ILF financing where the Seller receives payment on Usance tenor.

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service