Features

|

Customer Criteria |

Individual and Non-Individual |

|

Currency |

Rupiah |

|

Transaction Documentation System |

Statement / e-Statement |

|

Minimum Initial Deposit |

IDR 2,000,000 |

|

Retaining Balance |

IDR 50,000 |

|

Minimum balance required to avoid penalties |

IDR 5,000,000 |

|

Interest Rate |

Interest is calculated using a tiering concept that is based on daily balances, and will be credited to the appropriate Current Account at the end of the month after tax deductions in accordance with prevailing laws and regulations. |

|

Joint Account |

Combined accounts in the form of "AND" or "OR" are permitted. |

Risk

- Interest rate risk.

- Customers may lose the benefit of waived transaction fees and Cheque/BG book order fees if the required average balance is not maintained.

- Cheques and/or Bilyet Giro cashed through Clearing or over the counter may be rejected for payment or overbooked by the bank due to insufficient account balance or account closure, as specified in Bank Indonesia Regulation.

- Giro account holders may be added to the National Blacklist (DHN) if they meet Bank Indonesia's criteria for withdrawing blank Checks/Bilyet Giro.

Benefits

Transaction fees are waived in accordance with the following terms:

|

Average Balance (IDR) |

Number of Free Transactions Per Month *** |

|||

|---|---|---|---|---|

|

Clearing Deposits* |

SKN** |

RTGS** |

Buku Cek/BG** |

|

|

0 - < 100 millions |

All |

- |

- |

- |

|

100 millions - < 500 billions |

All |

55 |

10 |

1 |

|

500 billions - < 2 billions |

All |

55 |

15 |

2 |

|

2 billions - < 5 billions |

All |

55 |

25 |

3 |

|

5 billions - < 10 billions |

All |

55 |

35 |

5 |

|

>10 billions |

All |

All |

55 |

All |

* Waived fees are applied directly at the time of transaction.

** Waived fees are applied through a refund mechanism on every 10th of the following month based on the previous month's average balance.

*** Does not apply to fees debited on a consolidated or cash basis.

Fees

|

Description |

Nominal |

|---|---|

|

Monthly administration fee |

IDR 50,000 |

|

Penalties for below minimum balance |

IDR 50,000 |

|

Dormant fee |

IDR 100,000 |

|

Account closure |

IDR 50,000 |

Simulation

Simulation of waived transaction fees and Cheque/BG book for balances averaging 100 millions - < 500 millions:

|

Transaction |

Fee Per Transaction (IDR) |

Total Fee (IDR) |

|---|---|---|

|

55x SKN |

2,900 |

159,000 |

|

55x Clearing |

2,000 |

110,000 |

|

Cheque/BG Book (1 piece) |

275,000 |

275,000 |

|

10x RTGS |

30,000 |

300,000 |

|

Total monthly savings |

844,500 |

|

|

Total annual savings |

10,134,000 |

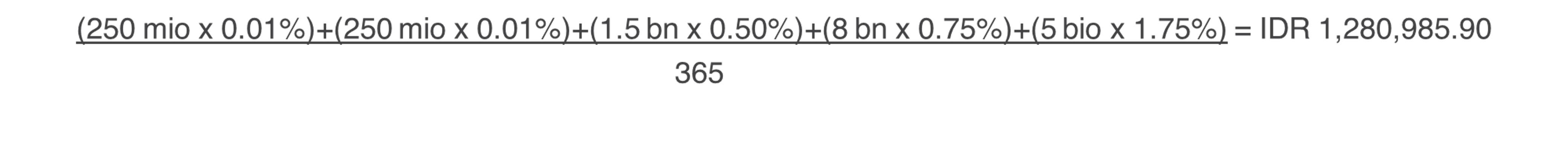

A simulation of how interest is calculated for a Giro BISA account (one day) with a balance of IDR 30,000,000,000, based on tiered interest rates as outlined below:

|

Tiering |

% |

|---|---|

|

0 - < 250 millions |

0.01% |

|

250 millions - < 500 millions |

0.01% |

|

500 millions - < 2 billions |

0.50% |

|

2 billions - < 10 billions |

0.75% |

|

10 billions - < 25 billions |

1.75% |

|

≥25 billions |

2.75% |

Gross Interest

Interest tax 20% = 1,280,958.90 x 20% = IDR 256,191.78

Net interest = 1,280,958.90 - 256,191.78 = IDR 1,024,767.12

Notes:

- The divisor used in the interest calculation corresponds to the number of calendar days in a year.

- The simulation provided above is solely for demonstration purposes.

- Features, interest rates, and fees are subject to change without prior notice.

Requirements and Procedures

- Fill out and sign the Customer Data and Account Opening Form.

- Prepare the necessary documents, including:

- Valid photocopy of identity card (KTP / SIM / Passport).

- Copy of NPWP (Taxpayer Identification Number).

- Additional required documents.

- The customer is required to provide accurate information and/or data as stated in the form and accompanying documents.

Information

For inquiries or complaints regarding Bank Danamon's BISA Current Account transactions/services, customers can contact Hello Danamon via phone at 1-500-090 or email at hellodanamon@danamon.co.id.

Contact Us

Contact Us

Location

Location

E-Form

E-Form

Whistleblower Service

Whistleblower Service